Creating Intelligent Corporate Perspectives

Capital markets data is expensive, complicated and offers little insight as to how issued securities prices will behave today, a week from now or even next month. Corporate issuers deserve empirical intelligence that accurately depicts the future of their stock and bond prices and the quantitative signals that drive them.

Trend Intelligence provides uniquely statistical, trend-following expertise that is clean, valuable and transparent. We give globally minded corporations the tools to better understand capital markets price trends and investor sentiment across global equity, bond, index, currency and commodity markets.

Trend Intelligence provides uniquely statistical, trend-following expertise that is clean, valuable and transparent. We give globally minded corporations the tools to better understand capital markets price trends and investor sentiment across global equity, bond, index, currency and commodity markets.

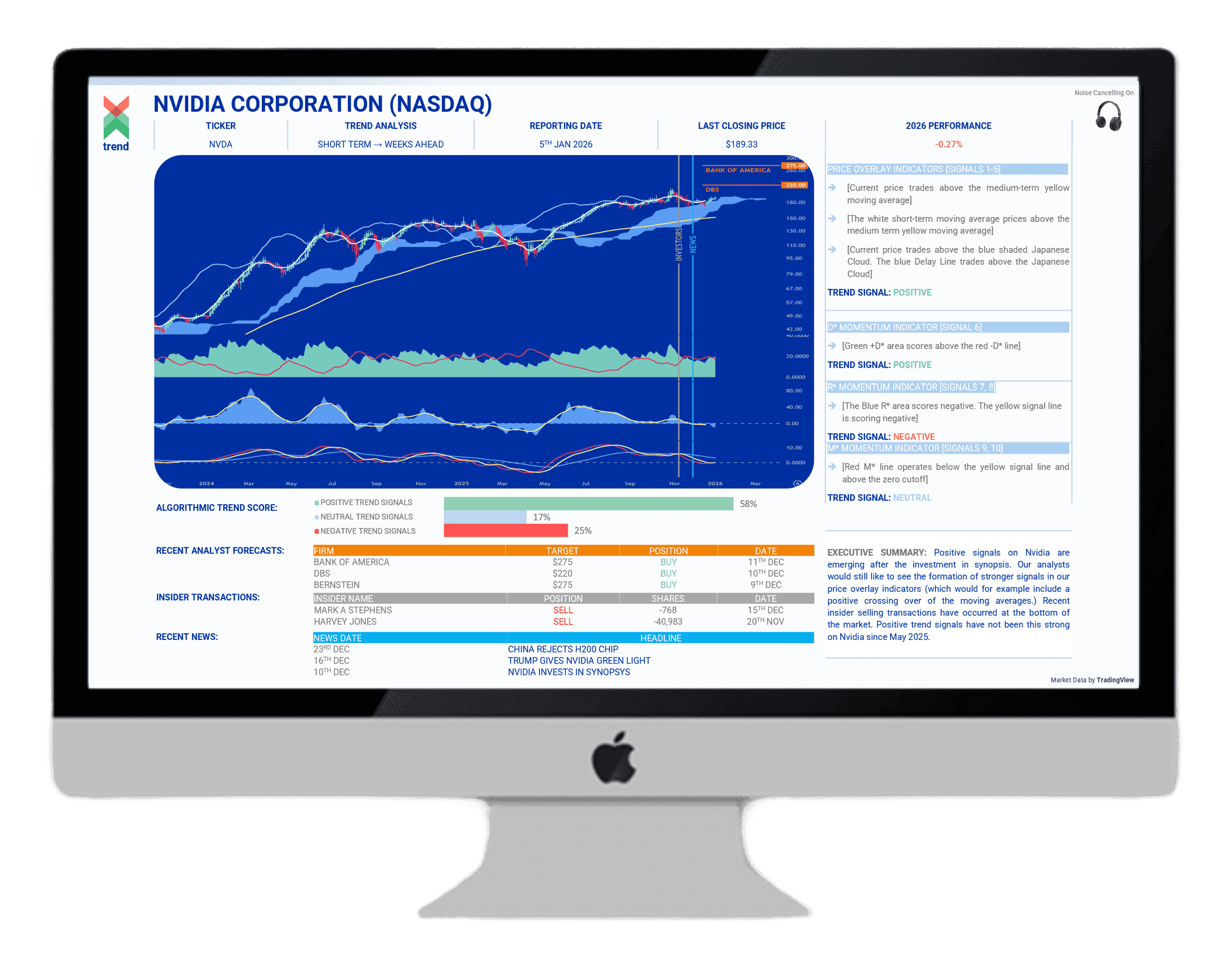

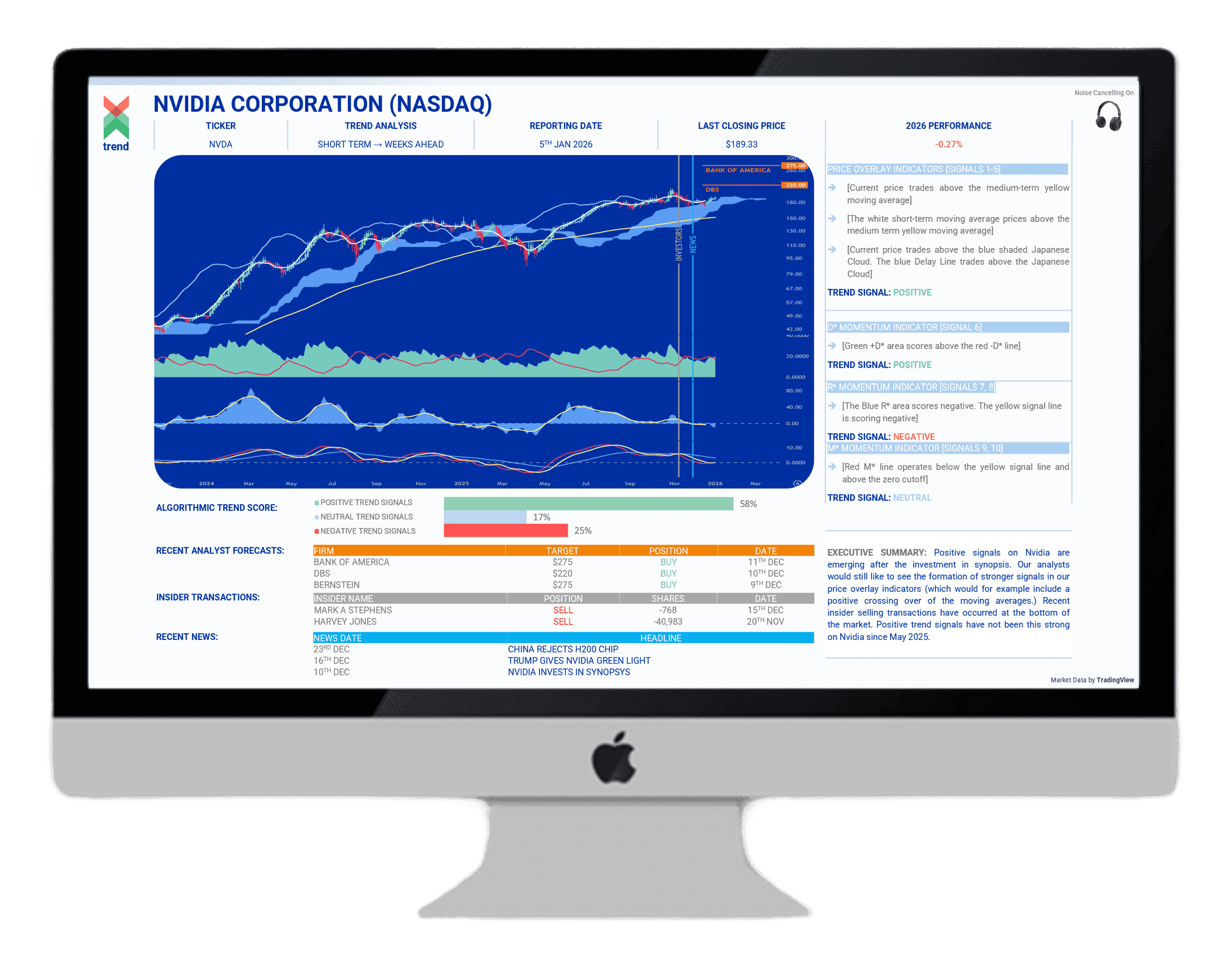

Quantitative Trend Analysis

Trends in equities, debt, FX, indices, ETFs & commodities

6 models & 10 signals analyze trend strength & sentiment

Perceive easy to read trend-following signals

Tailor our analytics to your industry and company needs

Communicate statistical expertise to your stakeholders

As Seen In

What Is Trend-Following?

‘Trend-following’ is a well-known quantitative investment strategy that uses price-based statistics to decipher the direction of a price trend, without the reliance on news, market fundamentals or price forecasts.

Pioneered far back in the 19th century, its benefits are still unrealized by corporate issuers. Trend-followers seek to uncover and capitalize on statistical trends shown in asset prices over time. This is a highly predictive, algorithmic approach that’s been the remit of many successful hedge funds since the 1980’s.

Now, Trend Intelligence repurposes trend-following algorithms for corporate issuers, serving as a forward-looking tool for a company’s securities prices, related indices, or currencies or commodities that can affect its valuation. Trend uses well-known ‘textbook’ trend-following indicators from the world of quantitative finance and seeks to establish itself as a standard bearer for trend-following reporting.

Some well known trend-following investors:

Sir David Harding

A pioneer in quantitative investing, Harding founded hedge funds Man AHL and Winton.

Charles Dow

A founding figure of trend-following and price analysis, Dow created the famous Dow Jones Index.

Jim Simons

Founder of Renaissance Technologies, Simons blended mathematics, science & investing.

More on trend-following:

SCHRODERS INVESTMENT MANAGEMENT

Trend Following Investment Strategies – Why Now?

INVESTOPEDIA

Trend Trading: The 4 Most Common Indicators

GRAHAM CAPITAL MANAGEMENT

Trend-Following Primer

MAN GROUP

Why Trend-Following?

WINTON

What Is Trend-Following?

AQR

A Century Of Evidence On Trend-Following

Our White Room

All of Trend’s algorithmic research takes place in our White Room – a purposeful white space that cuts out the noise of news, earnings, shareholder meetings and economic releases. In implementing this method Trend avoids contamination from human bias. Our clients can have confidence in accessing the most accurate statistical research throughout our platform.

About Our Founder

Adrian Dacruz created Trend as an innovative research and analytics platform serving global corporate issuers. Produced in Trend’s ‘White Room’ this intelligence uses trend-following algorithms to depict statistical trends across asset classes. The method deliberately avoids contamination from fundamental factors, economics and news.

Adrian holds a BA in Economics from the University of Leicester and an MBA from City University of London. Adrian is an accredited Member of the Society of Technical Analysts (MSTA) in the UK, a Member of the Investor Relations Society (MIRsoc) in the UK and Member of the National Investor Relations Institute (NIRI) in the United States.

Adrian has worked in financial markets since 2008, spanning market data at Bloomberg, equity derivatives at investment bank UBS and investor solutions for Europe’s largest hedge funds via The Bank of New York Mellon and State Street. More recently Adrian has worked within issuer services at S&P Global and the European stock exchange Deutsche Boerse Group. In addition to leading Trend, Adrian plays a material role for the market data and analytics fintech TradingView, a valuable data partner to Trend Intelligence.

Adrian Dacruz created Trend as an innovative research and analytics platform serving global corporate issuers. Produced in Trend’s ‘White Room’ this intelligence uses trend-following algorithms to depict statistical trends across asset classes. The method deliberately avoids contamination from fundamental factors, economics and news.

Adrian has worked in financial markets since 2008, spanning market data at Bloomberg, equity derivatives at investment bank UBS and investor solutions for Europe’s largest hedge funds via The Bank of New York Mellon and State Street. More recently Adrian has worked within issuer services at S&P Global and the European stock exchange Deutsche Boerse Group. In addition to leading Trend, Adrian plays a material role for the market data and analytics fintech TradingView, a valuable data partner to Trend Intelligence.

Adrian holds a BA in Economics from the University of Leicester and an MBA from City University of London. Adrian is an accredited Member of the Society of Technical Analysts (MSTA) in the UK, a Member of the Investor Relations Society (MIRsoc) in the UK and Member of the National Investor Relations Institute (NIRI) in the United States.