April 10th 2025 – Global risk assets aggressively rallied late on Wednesday afternoon as US president Donald Trump announced a respective pause to some of his global tariffs. The benchmark S&P 500 index settled 9.5% higher for the day – one of the highest daily price moves ever recorded for the index. The leading tech index, the Nasdaq 100, also settled an impressive 12% higher for the day.

Despite the huge positive price moves and change to sentiment, Trend Intelligence reports that the S&P 500 still remains in a strong negative trend and expects a further continuation of the US equity sell off that has dominated global headlines since late February.

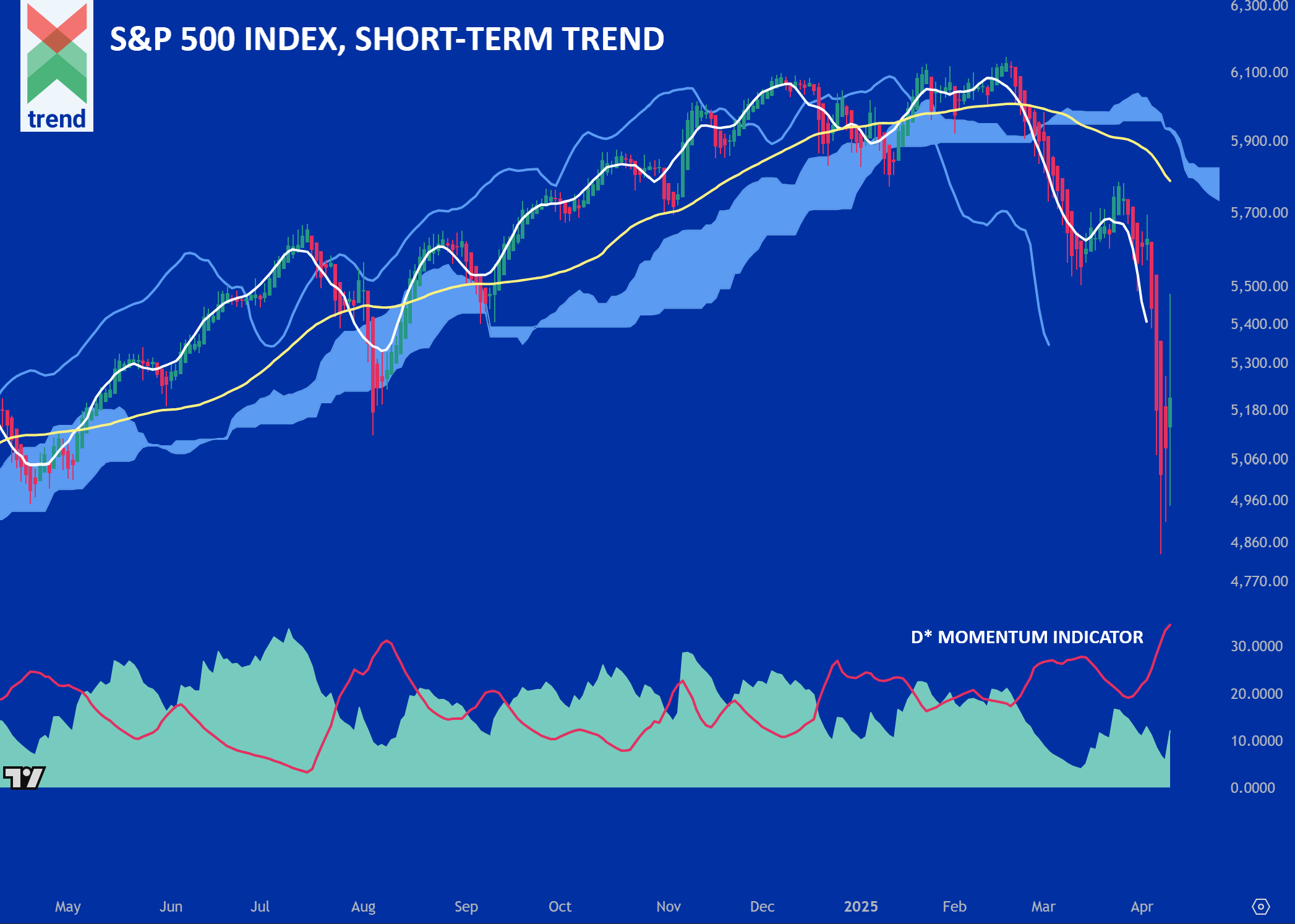

Trend’s Analysis (click chart to expand): Trend Intelligence uses a customized collection of trend-following signals, expressed in aggregate as a Trend Score, to demonstrate ongoing price trends across financial market indices and instruments.

In our S&P 500 chart, Trend Intelligence uses its D* Momentum Indicator to highlight its red (-D* Line) still operating far above the green (+D* Area). This is, and has shown over time to be, a negative trend signal.

In addition to our D* Momentum Indicator, the S&P 500 index continues to trade far below Trend’s medium-term (yellow) moving average and the Japanese Cloud indicator, shaded in blue. With respect to all indicators, Trend Intelligence remains negative on the S&P 500 index until the trend shows signs of ending.

Downside News: Despite the tariff pause, President Trump keeps a 10% tariff benchmark for the many countries on his hitlist. The president also singled out China for further tariffs, increasing levies on the world’s second-largest economy to now 125 per cent, reports the Financial Times.

Upside News: Interest rate cuts offer some light at the end of the tunnel and could support both equity and bond prices, helping avoid systemic risks to the financial system. Goldman Sachs retracted its immediate US recession forecast, and expects the Federal Reserve to cut interest rates by 25 basis points 3 times this year. An article from the Financial Times reports the need for an emergency rate cut from the fed, in light of US government bond yields continuing to rise.

- Click here to view Trend’s full report on the S&P 500 Index

Authored by Trend Intelligence, London