November 24th 2024 – The Euro Stoxx 50 Index now begins to show a cluster of negative medium-term trend signals reports Trend Intelligence, as current price (4,795) trends some 5.5% lower than its September 2024 highs of around 5,075.

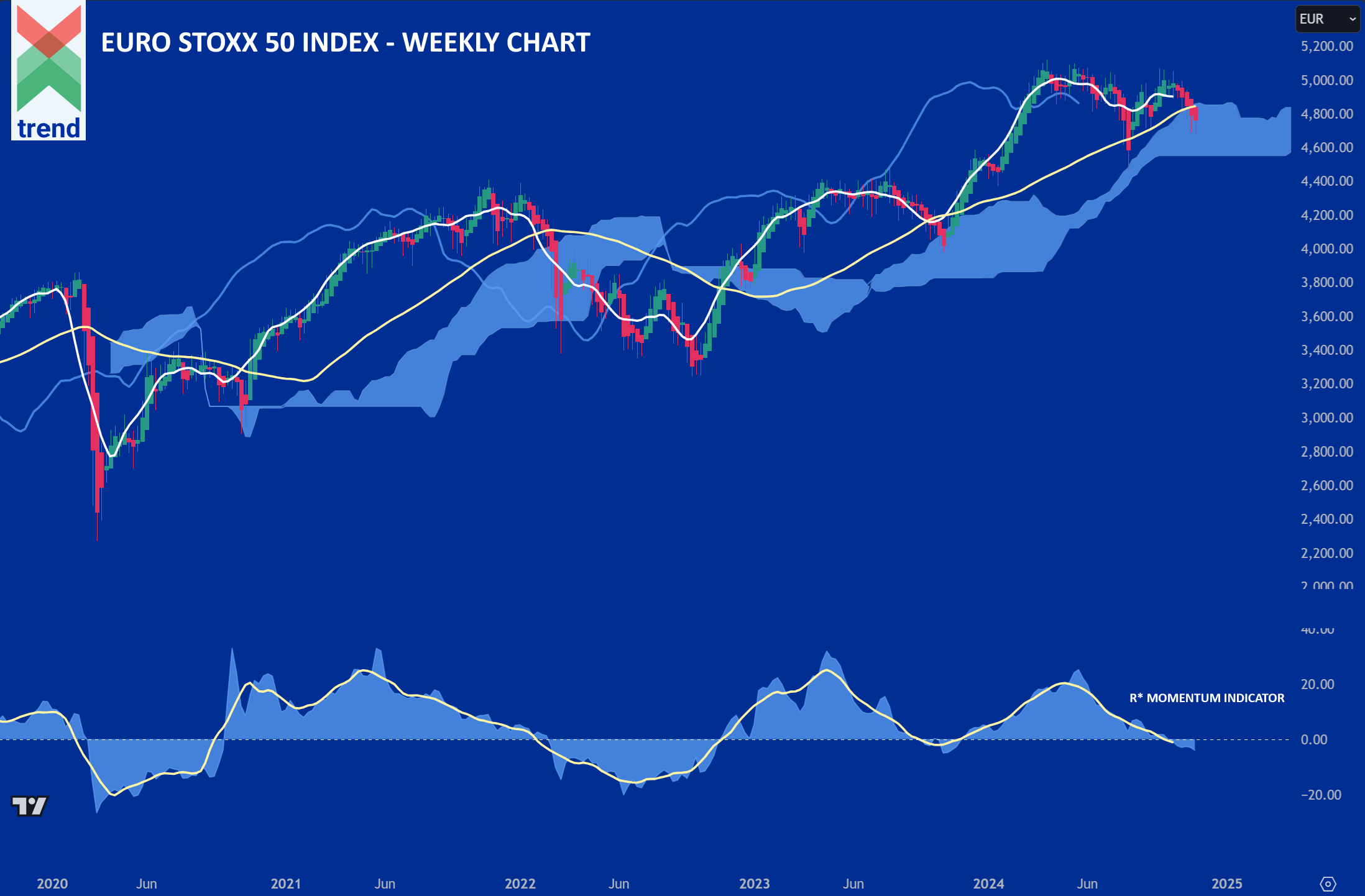

Trend’s Analysis (click chart to expand): In our Euro Stoxx 50 chart, Trend Intelligence displays a negatively trending R* Momentum Indicator with its yellow signal line. This is, and has shown over time to be, a negative trend signal.

In addition to our R* indicator, price currently trades below Trend’s yellow medium-term moving average, with the short-term white moving average posturing to cross below soon.

The combination of all signals corroborates Trend’s negative medium-term trend rating on the Euro Stoxx 50 Index, as we project continue downward moves in the index price in future weeks ahead.

Downside Sentiment: The much broader Stoxx Europe 600 index is up only marginally this year in dollar terms, and trails the S&P 500 this year by the widest margin on record. Analysts from Barclays state that a big “Trump premium” had opened up between the US and European markets – which are also expected to be at forefront of a coming trade war, reports the Financial Times.

Upside Sentiment: Back in October, the Financial Times reported that Investors are beginning to seek returns from the buoyant American market by turning to European stocks which have significant US exposure but are trading at a discount to their transatlantic counterparts.

Authored by: Trend Intelligence, London