November 30th 2024 – The price of Samsung Electronics continues to produce a cluster of negative medium-term trend signals reports Trend Intelligence, as its current share price of 54,200 KRW trades some 40% lower than its July 2024 highs of 89,000 KRW.

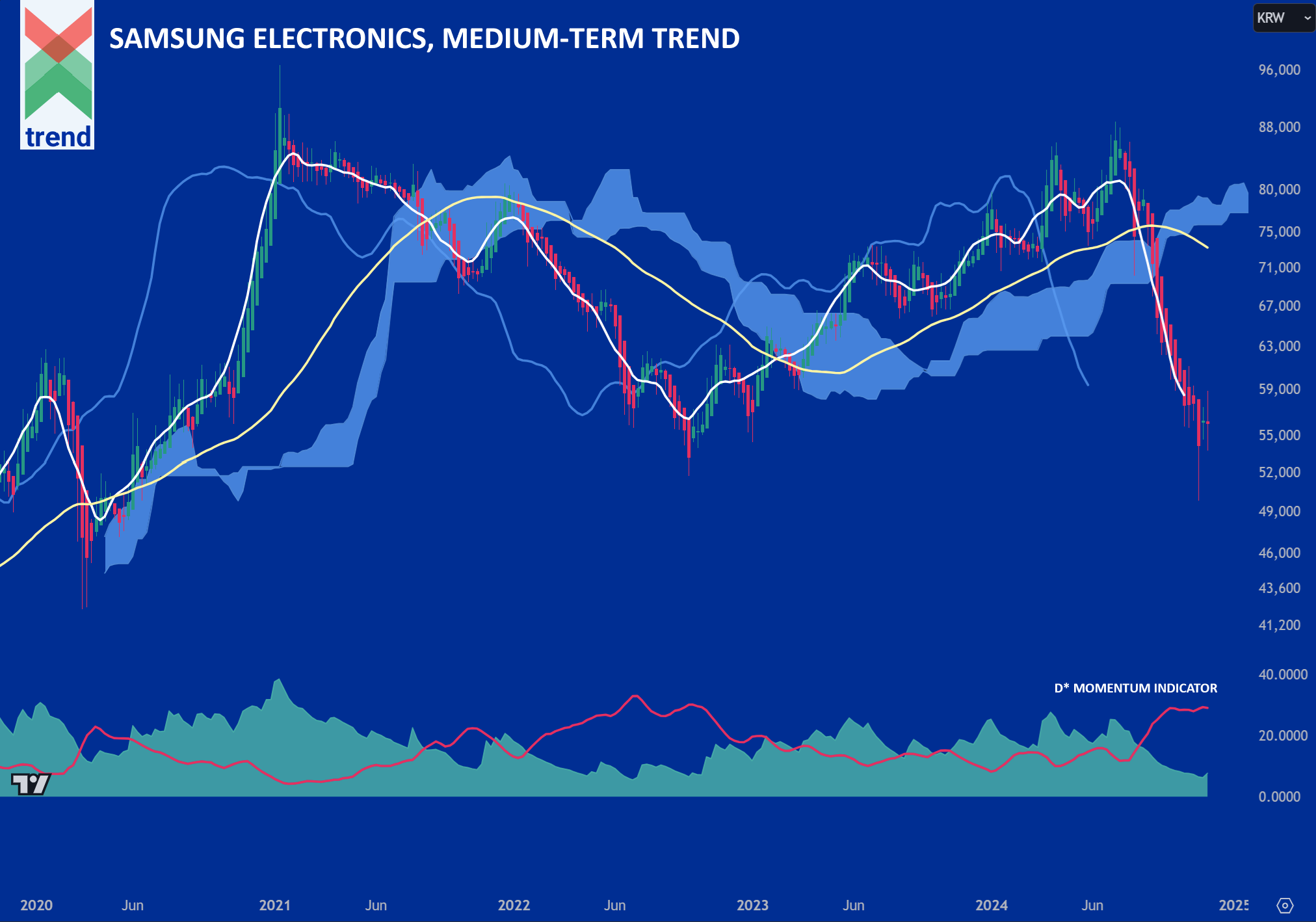

Trend’s Analysis (click chart to expand): In our Samsung Electronics chart, Trend Intelligence displays a negatively trending D* Momentum Indicator with the red (-D*) line far outstripping the green (+D*) area. This is, and has shown over time to be, a negative trend signal.

In addition to our D* indicator, price currently trades below Trend’s Japanese Cloud (in blue shading) and below our yellow medium-term moving average, with the short-term white moving average also crossing below it.

The combination of all signals corroborates Trend’s negative medium-term trend rating on Samsung Electronics, as we project continued downward moves in its share price for many weeks ahead.

Downside Sentiment: This week, Samsung Electronics announced the second management shake-up of its chip division this year, illustrating the turmoil that Samsung faces over its competitiveness in advanced memory chips used for AI. The move comes as the world’s largest memory chipmaker faces increasing losses in its chipmaking business and struggles to close the gap on market leader TSMC, reports the Financial Times.

Upside Sentiment: In mid November, shares of Samsung Electronics jumped some 7% after the company unveiled a surprise plan to buy back about 10 trillion South Korean won ($7.19 billion) worth of its own stock over the next 12 months. Future additional buyback plans could add increasing upside pressure to Samsung’s share price, reports CNBC.

Authored by: Trend Intelligence, London