December 19th 2024 – The price of the US Dollar weighted against a basket of other currencies in the well known DXY Index continues to exhibit a positive medium-term trend reports Trend Intelligence, as the current index level of $108.43 sits some 8% higher than its recent September 2024 lows of $100.

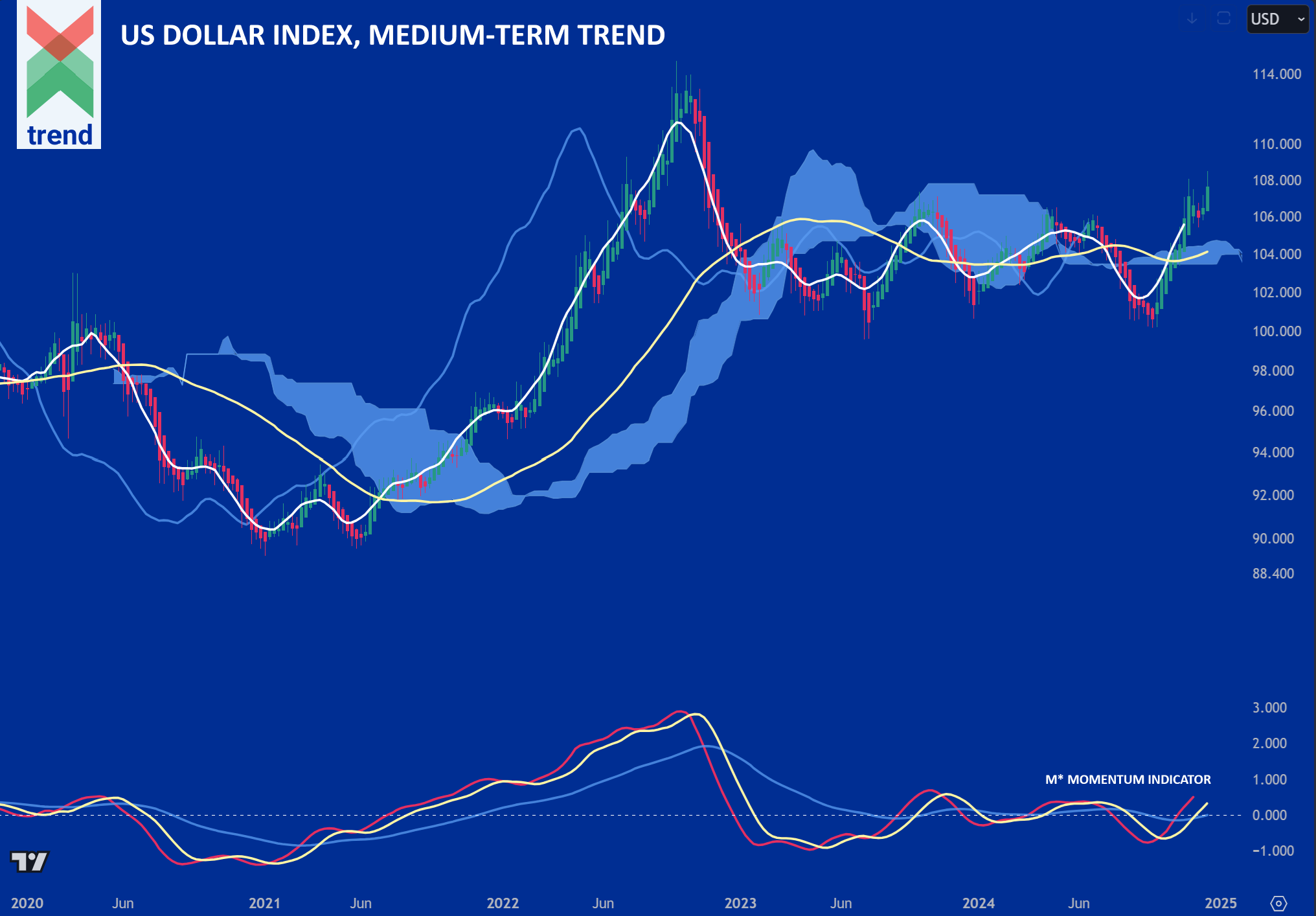

Trend’s Analysis (click chart to expand): In our DXY Index chart, Trend Intelligence uses its M* Momentum Indicator to report a positively trending M* line, above both of Trend’s Signal blue and yellow signal lines. This is, and has shown over time to be, a positive trend signal.

In addition to our M* indicator, DXY’s price currently trades above both of Trend’s moving averages and above our Japanese Cloud indicator, shaded in blue.

The combination of all signals corroborates Trend’s positive medium-term trend rating on the DXY Index, as we project continued upward moves in its price until the trend shows signs of reversing.

Downside Sentiment: In October, UBS reported that they expect the US dollar to strengthen in the event of a second Trump administration, but that this strength will begin to fade over time. Potential tariffs are likely to hurt US consumers and GDP more than the rest of the world, and US deficit concerns may also surface with tax cuts.

Upside Sentiment: This week leading central banks have warned that inflation is proving stickier than expected and that they will only cut borrowing costs gradually in 2025. This as inflation has begun to pick up again in both the US and UK, while uncertainties over the policies of US president-elect Donald Trump are clouding economic prospects across the globe, reports the Financial Times.

Authored by: Trend Intelligence, London