March 23rd 2025 – European beauty group L’Oréal stands to lose a significant part of its revenue and market share should the company become a part of the EU’s tit-for-tat trade war with US president Donald Trump, reports the Financial Times.

Trend’s Analysis (click chart to expand): Trend Intelligence uses a customized collection of trend-following signals, expressed in aggregate as a Trend Score, to demonstrate ongoing price trends across financial market indices and instruments.

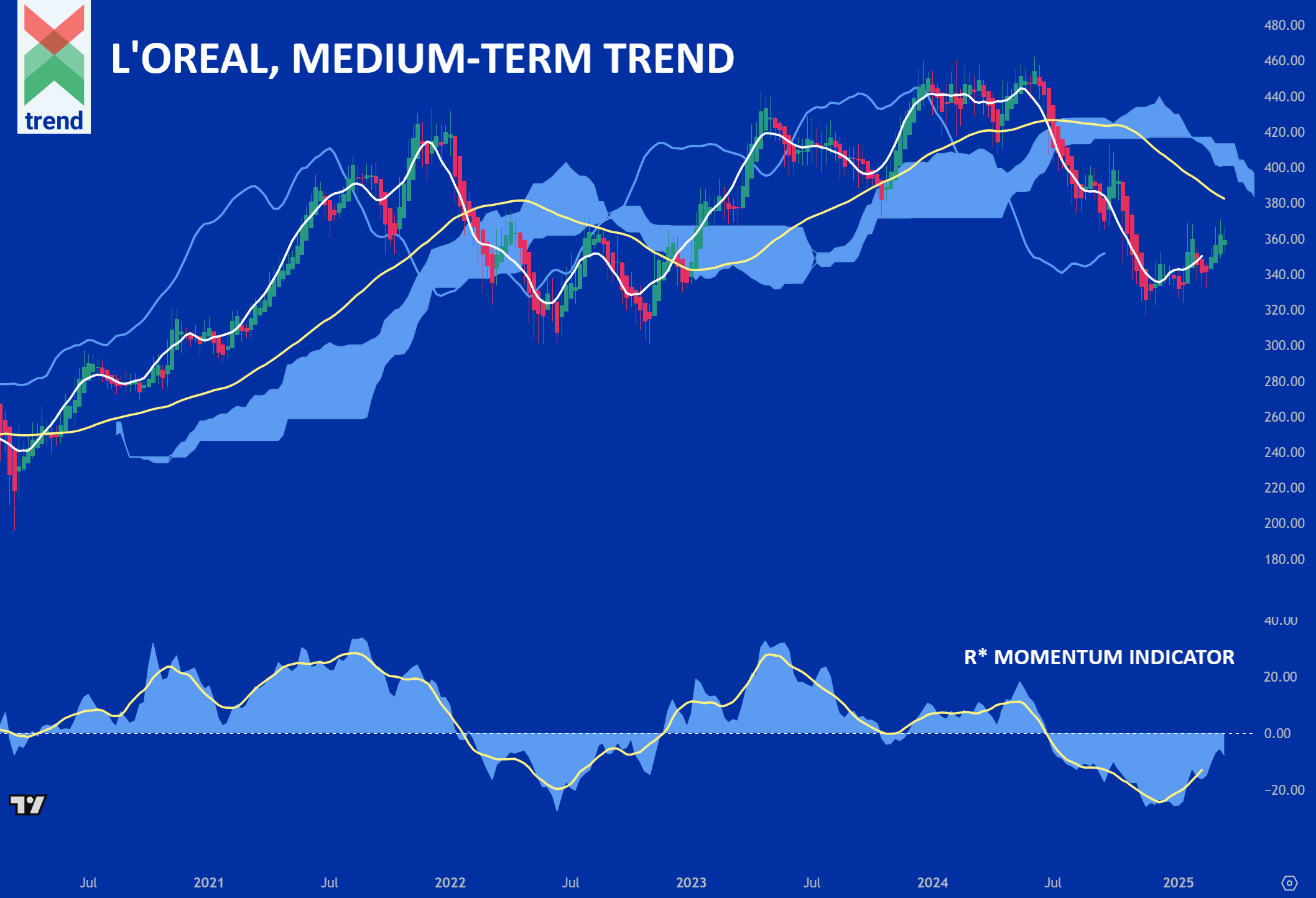

In our L’Oréal chart, Trend Intelligence uses its R* Momentum Indicator to indicate that its R* Area (blue) and R* Signal Line (yellow) trade below the zero (horizontal) cutoff line. This is, and has shown over time to be, a negative trend signal.

In addition to Trend’s R* Momentum Indicator, L’Oréal currently prices far below Trend’s medium-term (yellow) moving average and Japanese Cloud indicator (shaded in blue). With respect to all indicators, Trend Intelligence remains strongly negative on L’Oréal in the medium term, and until the trend shows signs of ending.

Downside News: In February, Morningstar assigned L’Oréal a Medium Uncertainty Rating, based on emerging macroeconomic headwinds and geopolitical tensions that could weigh on consumer demand. ‘L’Oréal depends on stable trade policies and collaborative global supply chains to ensure timely and cost-effective delivery of its products. Any reversal of open trade policies is a risk that could affect its growth’, reported Morningstar.

Upside News: L’Oreal will continue expending significant resources towards research, development and marketing, reinforcing L’Oreal’s brand standing and pricing power. ‘Steady increases in beauty demand globally and L’Oreal’s ability to slightly outpace the overall market add room for market share gains in the highly fragmented beauty sphere.’ reported Morningstar.

Authored by Trend Intelligence, London