October 12th 2025 – AstraZeneca’s London listed equity price continues in a strongly positive short-term trend after the pharmaceutical giant agreed to a new range of measures giving US patients access to medicine at heavily discounted prices. As part of the historic deal with the Trump administration, AstraZeneca will provide direct-to-consumer sales of medications at a discount of up to 80% off listed prices, reports AstraZeneca.

Trend analysis (click chart to expand): Trend Intelligence uses a customized collection of trend-following signals and algorithms to demonstrate ongoing price trends across financial markets to the benefit of corporate C-Suite, Treasury and Investor Relations teams.

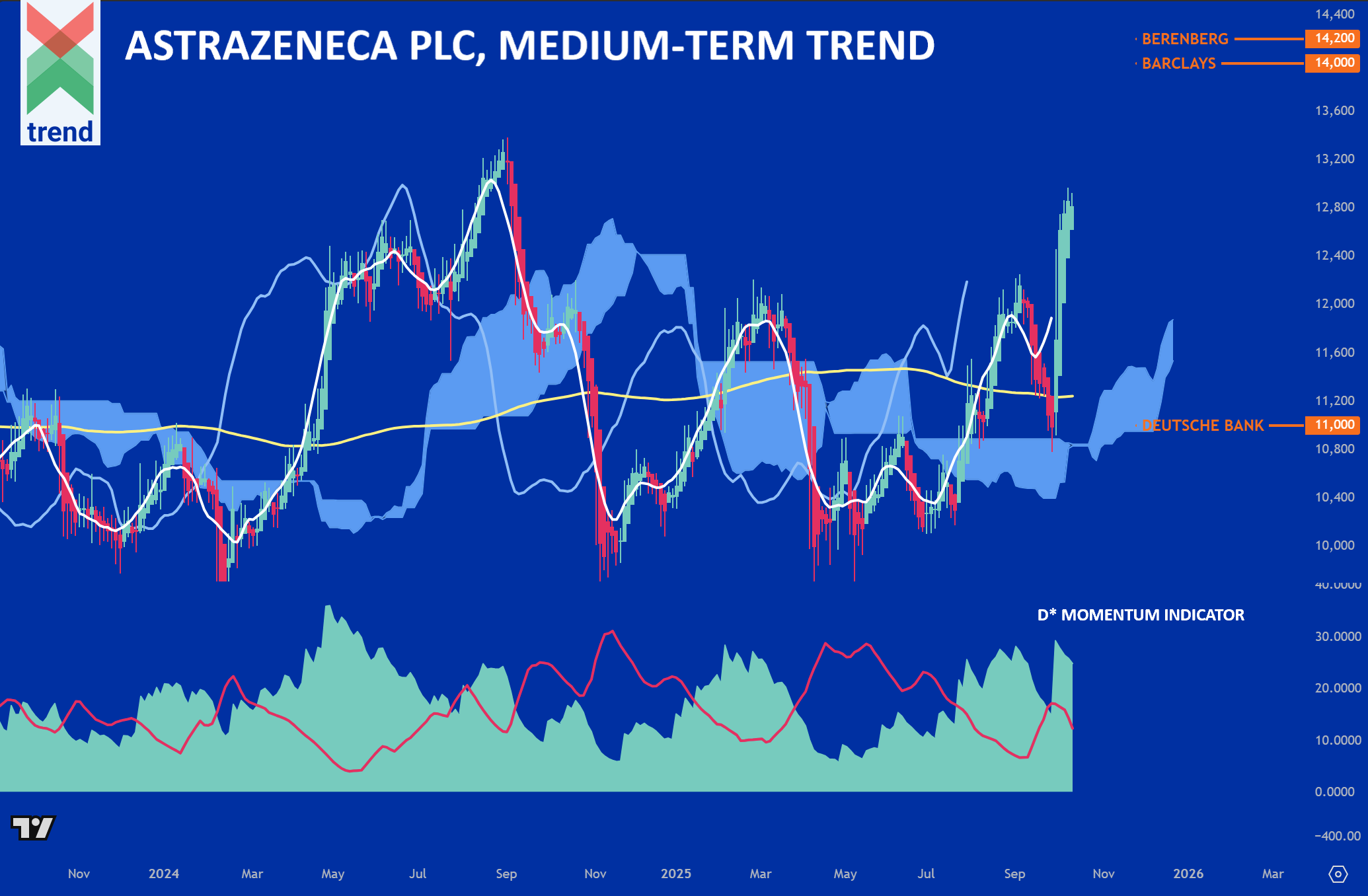

In our AstraZeneca analysis, Trend Intelligence runs its D* Momentum model displaying an ongoing positive trend – with the green +D* area scoring above the red signal line since July 2025.

In addition to our D* Momentum model, AstraZeneca’s price trades above both long and short-term moving averages and Trend’s Japanese Cloud indicator (shaded in blue).

With respect to all signals, Trend Intelligence remains short-term trend positive on AstraZeneca, heading towards the higher analyst targets of Berenberg and Barclays.

Positive news supporting the trend: AstraZeneca is the first foreign drugmaker to make a deal with the Trump administration. CEO Pascal Soriot has been keen to stress that the group is a “very American company” and recently announced plans for the company to list directly in New York, reports the Financial Times. Investment firm Aberdeen Group grew its position in AstraZeneca by 2% in the second quarter, and several other hedge funds and institutional investors have also added to their positions, reports MarketBeat.

Produced by Trend Intelligence. Market data by TradingView.