November 3rd 2025 – Berkshire Hathaway’s US listed equity price has entered into a short-term negative trend reports Trend Intelligence. The signal comes after the investment giant disclosed over the weekend that it had sold another $6.1 billion of common stock in the third quarter, now putting its cash reserves at a new high of $382 billion, reports the Financial Times.

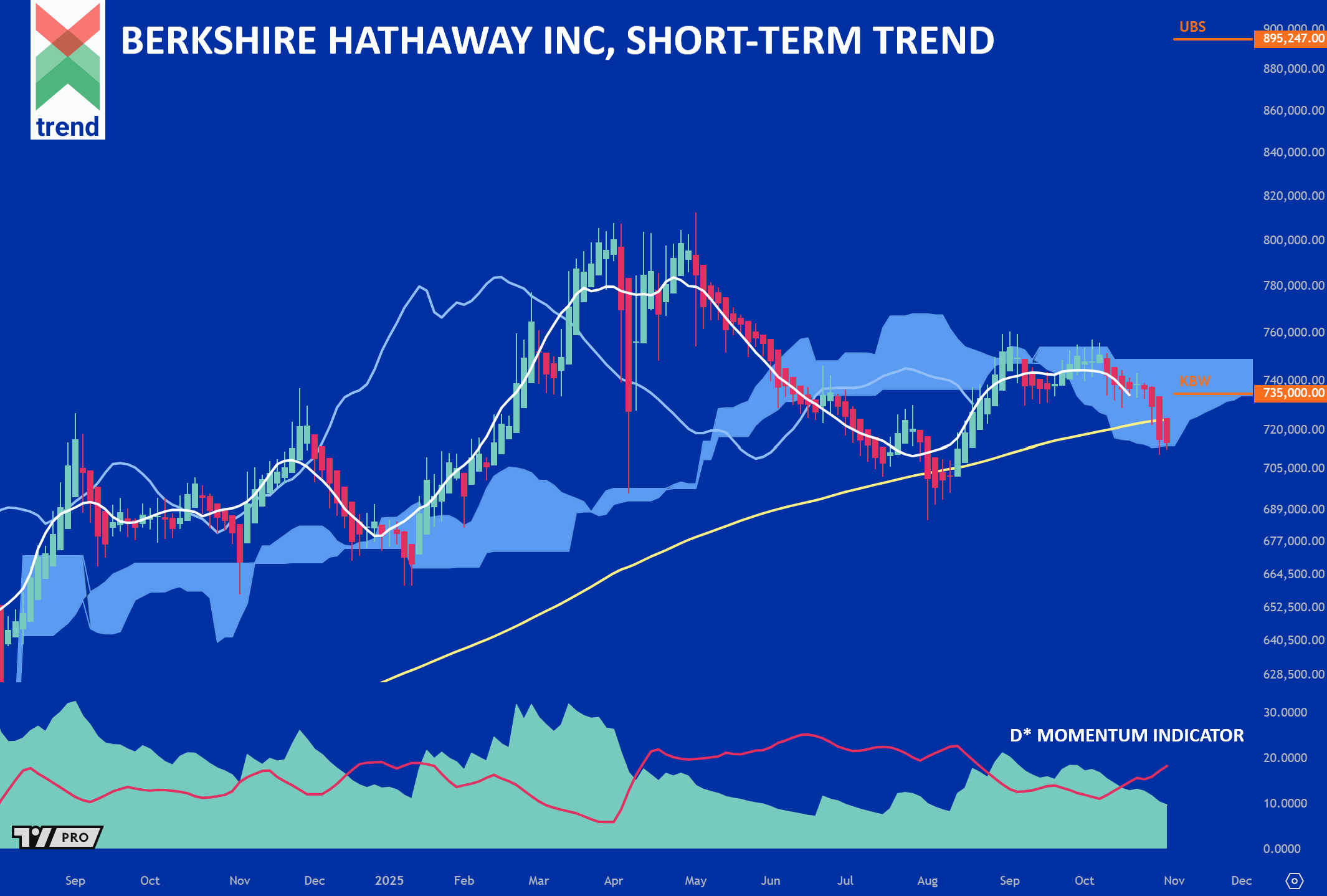

Trend analysis (click chart to expand): Trend Intelligence uses a customized collection of trend-following signals and algorithms to demonstrate ongoing price trends across financial markets to the benefit of corporate C-Suite, Treasury and Investor Relations teams.

In our Berkshire Hathaway analysis, Trend Intelligence runs its D* Momentum model displaying an ongoing negative trend – with the green +D* area scoring below above the red signal line since 20th October 2025.

In addition to our D* Momentum model, Berkshire Hathaway’s price trades below Trend’s long term moving average and also appears to be breaking below Trend’s Japanese Cloud indicator (shaded in blue).

With respect to all signals, Trend Intelligence remains short-term trend negative on Berkshire Hathaway, heading away from the higher analyst targets of UBS and KBW.

Negative news supporting the trend: Berkshire Hathaway’s share price has lagged the benchmark S&P 500 index since 95-year-old Buffett announced plans to step down. Class A shares have fallen around 12 per cent as the S&P rose 20 per cent. Berkshire’s non- financial businesses also took a $1.1bn hit this year from California wildfires that devastated Los Angeles. Berkshire also announced that it did not buy back any shares for the fifth consecutive quarter, with Buffett deciding to stay on the sidelines, reports the Financial Times.

Produced by Trend Intelligence. Market data by TradingView.