May 30th 2024 – The share price of oil major Shell Plc is now exhibiting a negative short-term trend reports Trend Intelligence, as shares of Shell have fallen some 6% from their May 2024 all-time high of £29.60

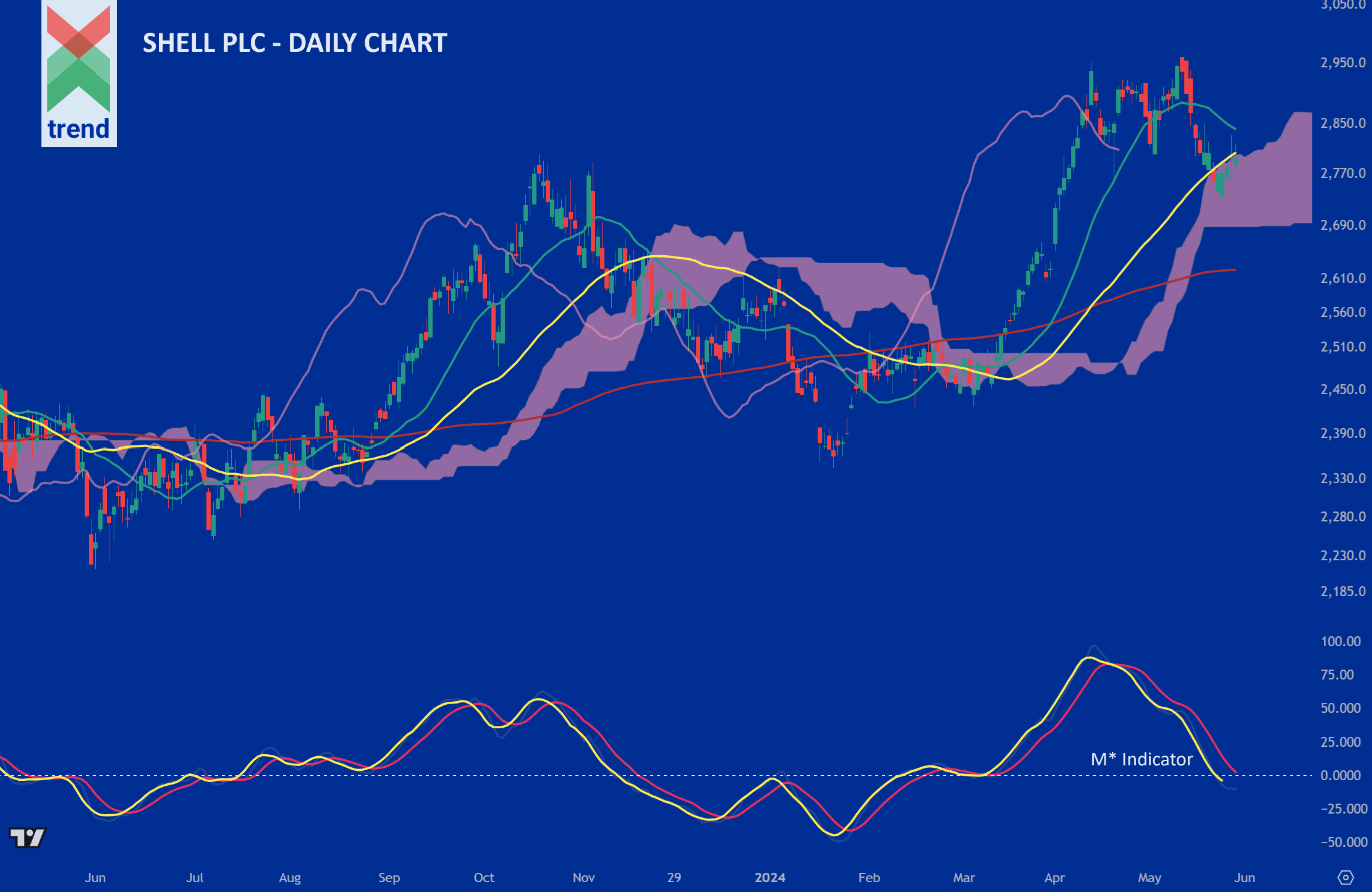

Trend’s Analysis (click chart to expand): Trend’s M* Momentum Indicator creates a clear visual representation of price trends in play across asset classes and financial instruments. In our Shell Plc chart, Trend Intelligence reports negatively trending M* and M* Signal lines, with both indicators now moments away from crossing below their critical zero line. This is, and has shown over time to be, a negative trend signal.

In addition to the M* indicator, price currently trades below 2 of Trend’s moving averages (short-term and medium-term), but positively still above our Japanese Cloud indicator (in pink shading) which is currently offering some support to prices.

The combination of the aforementioned negative signals corroborates Trend’s negative short-term trend rating on Shell Plc, as we project negative price returns for the future weeks ahead.

Downside Sentiment: In May 2024, 78% of Shell shareholders backed the oil major’s decision to weaken its climate targets in a blow for environmental groups that have pushed the company to take stronger action to cut emissions, reports the Financial Times.

Upside Sentiment: Also in May, Wael Sawan, who became Shell’s chief executive in 2023, messaged that the company’s “pragmatic approach” would see “enhanced shareholder returns” as he now focuses more on generating cash flow at the expense of it spending on low carbon projects, reports the Financial Times.

Authored by: Trend Intelligence, London