June 10th 2024 – The share price of Parisian luxury fashion brand Louis Vuitton Moet Hennessy (LVMH) is continuing its negative short-term trend reports Trend Intelligence, as the price has fallen some 16% from its March 2024 high and now trades at around 750 Euros a share.

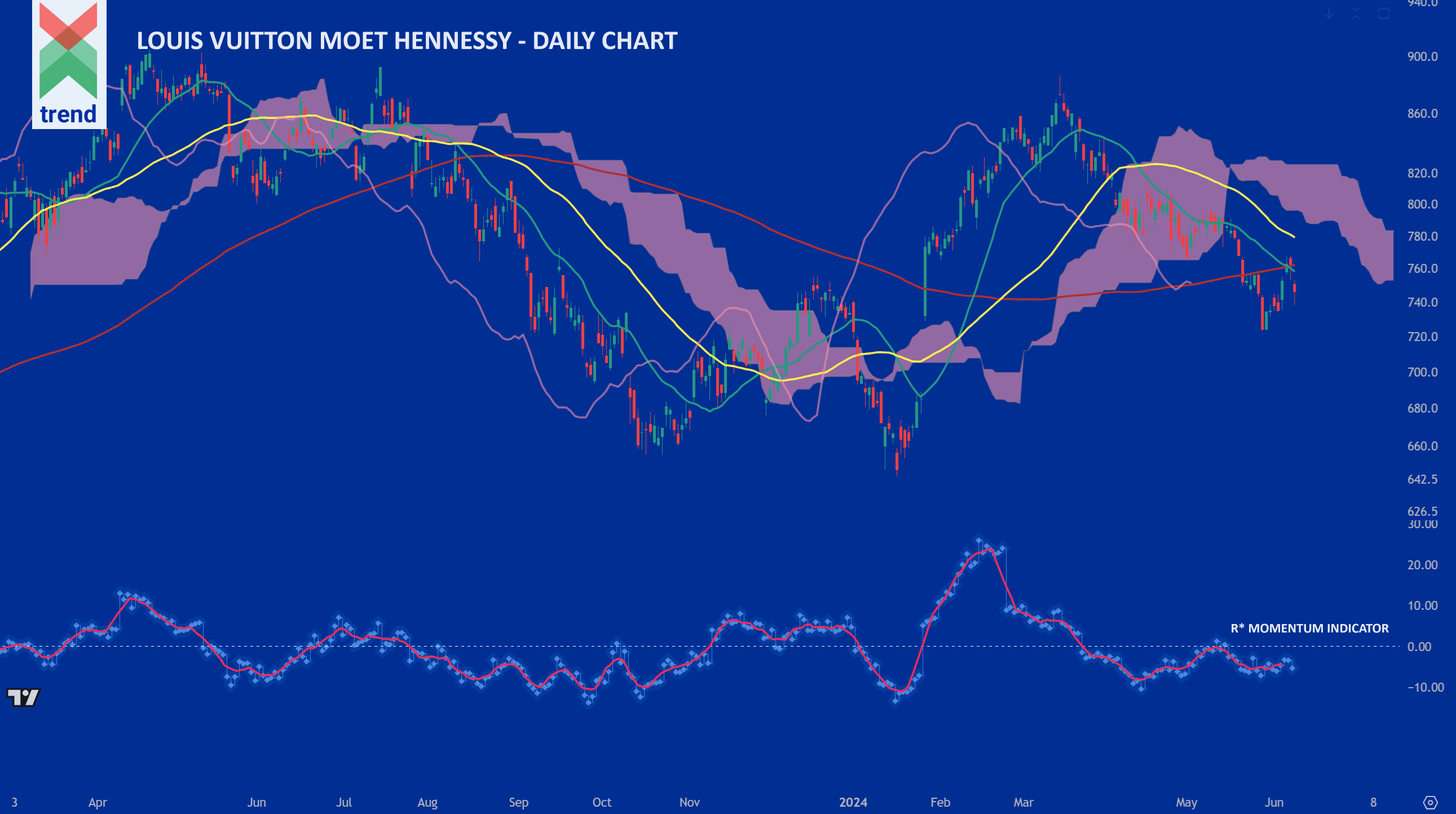

Trend’s Analysis (click chart to expand): Trend’s R* Momentum Indicator creates a clear visual representation of price trends in play across asset classes and financial instruments. In our LVMH chart, Trend Intelligence reports negatively trending R* and R* Signal lines, with both indicators now operating below the critical zero line. This is, and has shown over time to be, a negative trend signal.

In addition to the R* indicator, price currently trades below all 3 of Trend’s moving averages and below our Japanese Cloud indicator shaded pink.

The combination of these signals corroborates Trend’s negative short-term trend rating on the luxury fashion maker – with the price looking negative for the future weeks ahead.

Downside Sentiment: In April 2024 LVMH reported its weakest quarterly sales growth since the start of 2021, as Chinese demand subsided and champagne sales fell. China has become a more complex situation for the sector as luxury goods demand softens amid an uncertain economic outlook and increased trade tensions with Europe, reports the Financial Times.

Upside Sentiment: Global sales of handbags and perfumes made by LVMH account for a larger share of France’s exports than all of the Camembert and wine it produces. The Paris-based luxury leader accounted for 4 per cent of all French exports last year. All five of CEO Bernard Arnault’s children work at the company in operational roles – most with board seats in a deliberate move not to dilute the strength of the brand in future years, reports the Financial Times.

Authored by: Trend Intelligence, London