June 11th 2024 – The share price of alcoholic beverage giant Diago PLC, owner of Guiness, Smirnoff and Baileys is now exhibiting a negative medium-term trend reports Trend Intelligence, as shares of the company have fallen some 37% from their January 2022 all-time high of close to £41 a share.

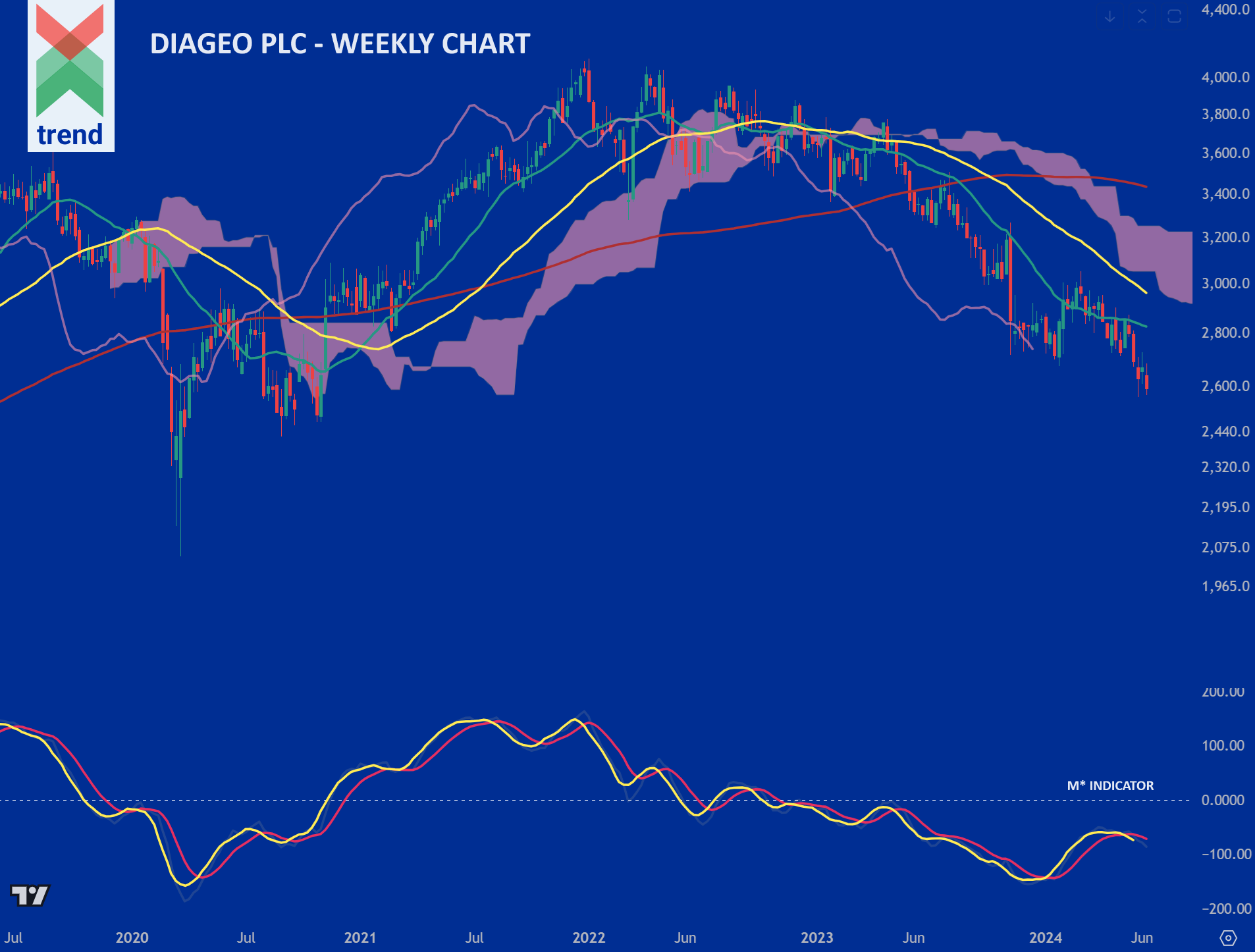

Trend’s Analysis (click chart to expand): Trend’s M* Momentum Indicator creates a clear visual representation of price trends in play across asset classes and financial instruments. In our Diageo Plc chart, Trend Intelligence reports negatively trending M* and M* Signal lines, with both indicators now operating far below their critical zero line. This is, and has shown over time to be, a negative trend signal.

In addition to the M* indicator, price currently trades below all 3 of Trend’s moving averages and below our Japanese Cloud shaded pink.

The combination of all of these signals corroborates Trend’s negative medium-term trend rating on Diageo Plc, as we project negative price returns for the future weeks and months ahead.

Downside Sentiment: The drinks group issued a profit warning last year because of a projected 20% sales drop in Latin America, which accounts for more than a tenth of Diageo’s sales value. Weaker demand for spirits, particularly in its crucial US market, has also weighed on the company. Today Diageo also announced that has sold its Guiness Nigeria for about 70 million US dollars, freeing up cash, reports the Financial Times.

Upside Sentiment: Over the last 10 years, Diageo has managed to achieve an average ROE of around 28%. That’s significantly higher than the FTSE 100 average of 11%. Last month, UK pub group JD Wetherspoon issued a trading update noting that sales of Guinness had been growing strongly outside of its traditional customer base. Guinness accounts for around 20% of Diageo’s total revenues, reports Yahoo Finance.

Authored by: Trend Intelligence, London