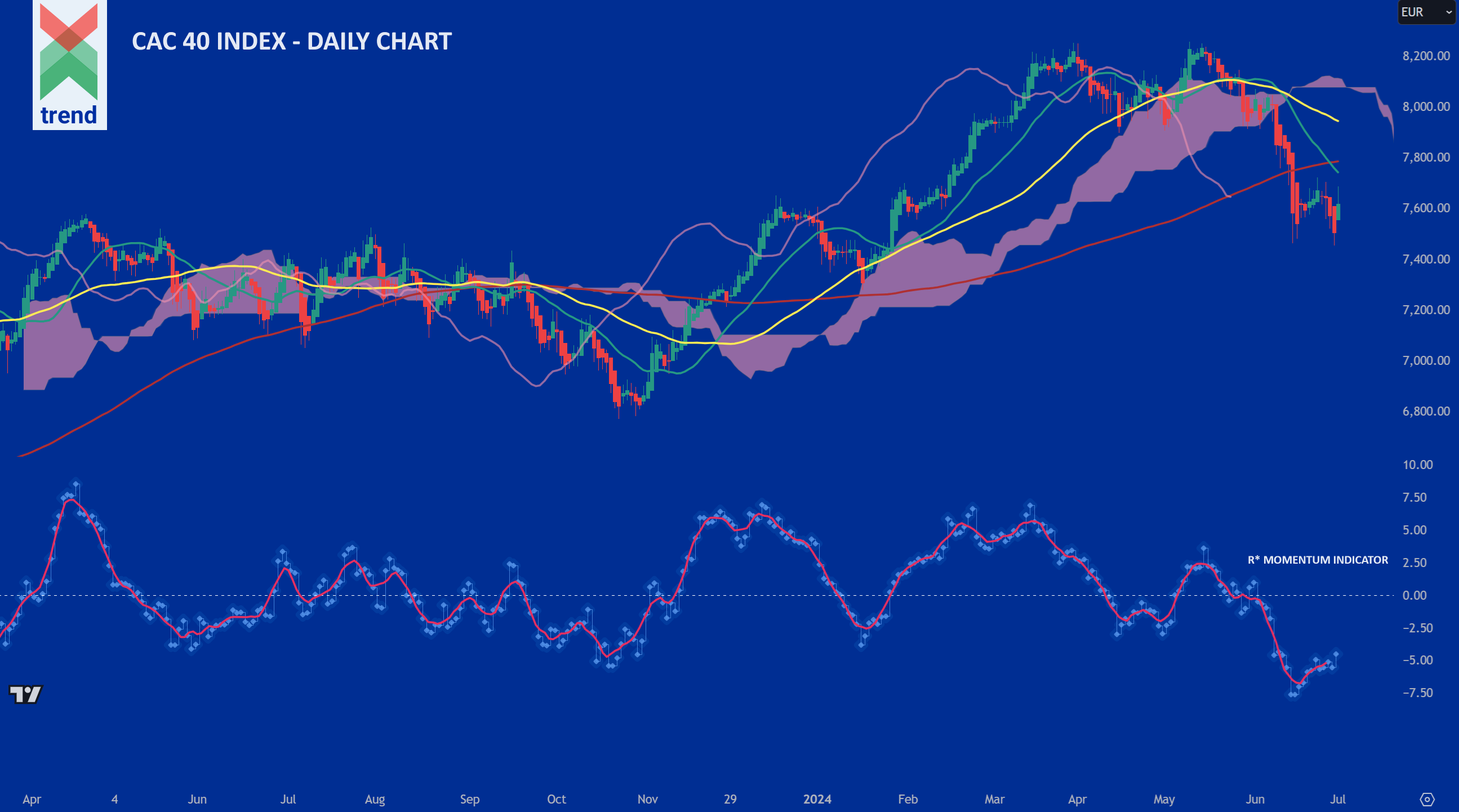

1st July 2024 – The price of the French CAC 40 Index continues its negative short-term trend reports Trend Intelligence, as the index closed at 7,561 Euros having fallen some 8% from its respective March and May price highs.

Trend’s Analysis (click chart to expand): Trend’s R* Momentum Indicator creates a clear visual representation of price trends in play across asset classes and financial instruments. In our CAC 40 chart, Trend Intelligence reports negatively trending R* and R* Signal lines, with both indicators operating below the critical zero line. This is, and has shown over time to be, a negative trend signal.

In addition to the R* indicator, price currently trades well below all 3 of Trend’s moving averages and below our Japanese Cloud indicator, which is shaded pink.

The combination of these signals corroborates Trend’s negative short-term trend rating on the French index, with the price looking negative for the future days and weeks ahead.

Downside Sentiment: The Financial Times reports that in response to the first round of national elections that put the Rassemblement National in the lead, the gap between benchmark French and German 10-year borrowing costs rose to 0.85 percentage points (the highest level since the Eurozone debt crisis in 2012). The risk of this continued erosion of French sovereign creditworthiness, in addition to accumulating inflation, could also make French debt unattractive in the medium term.

Upside Sentiment: IG Index’s Axel Rudolph, the man who awarded this author’s MSTA designation in technical analysis, recommends buying the CAC 40 at these levels, with the index expected to stay volatile until the second round of elections this coming Sunday.

Authored by: Trend Intelligence, London