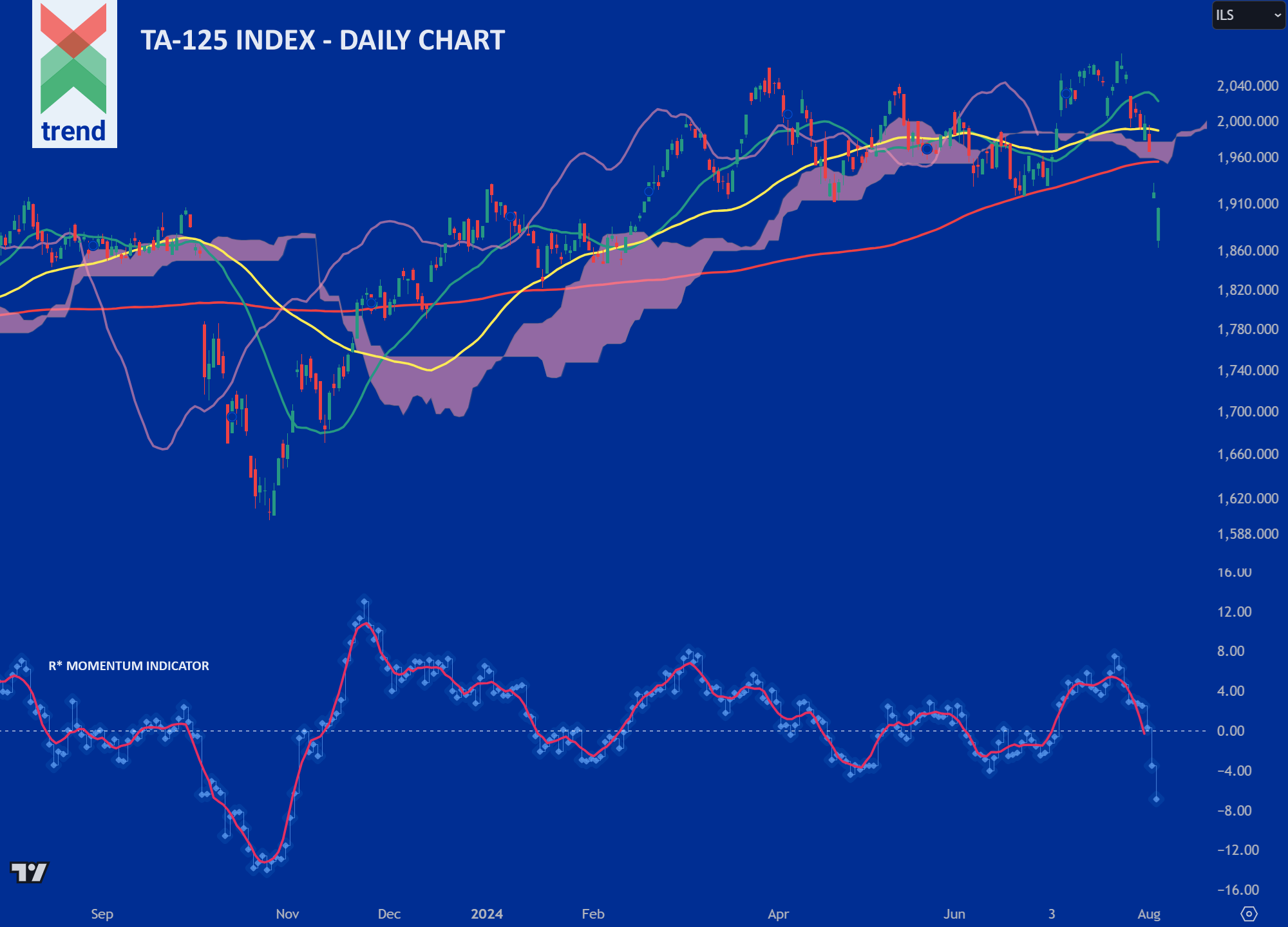

5th August 2024 – Amid a devastating global sell-off in global risk assets, Israel’s leading TA-125 equity index has entered a negative short-term trend reports Trend Intelligence, as its price closed at just over 1,900 ILS having fallen some 12% since its 2022 highs.

Trend’s Analysis (click chart to expand): Trend’s R* Momentum Indicator creates a clear visual representation of price trends in play across asset classes and financial instruments. In our TA-125 chart, Trend Intelligence reports aggressively negative trending R* and R* Signal lines, with both indicators operating below the critical zero line. This is, and has shown over time to be, a negative trend signal.

In addition to the R* indicator, price currently trades well below all 3 of Trend’s moving averages and below our Japanese Cloud indicator, which is shaded pink. The case could be made for the index being short-term oversold, but this is not described by trend-following as a quantitative strategy.

The combination of all signals corroborates Trend’s negative short-term trend rating on the TA-125 with the price looking negative for the future days and weeks ahead.

Downside Sentiment: The prospect of a full-scale war with Iran and its military proxies is disrupting the Israeli economy and moving human resources into military service. New rocket attacks from Lebanese territory in the north of Israel are forcing residents to flee, reports the Financial Times.

Upside Sentiment: Israel’s economy shrank by 5.2% in Q4 2023 as labour force disruption resulted in around 300,000 reservists being called up to the country’s armed forces. Benjamin Bental, professor of economics at the University of Haifa, says that Israel’s labour market is now finally recovering from the sudden departure of so many workers and small business owners from the economy, reports DW News.

Authored by: Trend Intelligence, London