August 6th 2024 – The price of the Nasdaq 100 index, the eminent US big tech index, remains in a positive medium-term trend reports Trend Intelligence, as the index closed down close to 3% yesterday and has fallen some 15% from its all-time high in July 2024.

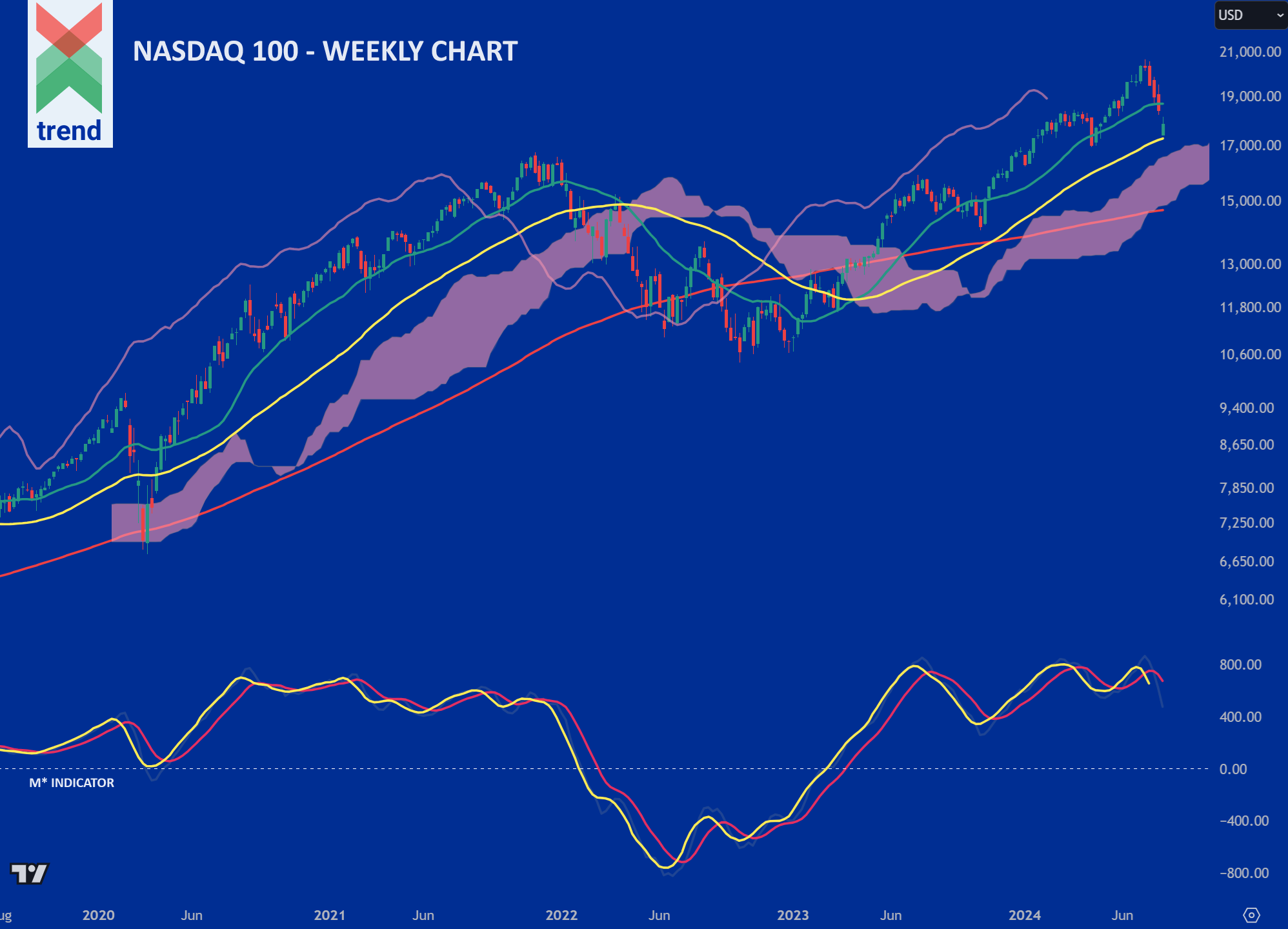

Trend’s Analysis (click chart to expand): Trend’s M* Momentum Indicator creates a clear visual representation of price trends in play across indices, asset classes and financial instruments. In our Nasdaq 100 chart, Trend Intelligence reports negatively trending M* and M* Signal lines, but with both indications still operating above their critical zero line. This is, and has shown over time to be, a neutral trend signal.

In addition to the M* indicator, price currently trades above 2 of Trend’s moving averages and still above our Japanese Cloud, shaded in pink.

The combination of all of these signals corroborates Trend’s positive medium-term trend rating on the Nasdaq 100, as we project neutral/positive price returns for the future weeks and months ahead.

Downside Sentiment: Global markets concerns continue to swirl over the trajectory of the US economy. Goldman Sachs said this weekend that it believed that there is a 25% chance of the US falling into recession in the next year, compared with its previous odds of 15%, reports the Financial Times.

Upside Sentiment: Recession worries are not a huge contributor. The move in the Treasuries and corporate bond spreads would have to be much larger before the markets concluded that recession fears are the biggest driver. Economic data remains mixed rather than bad, reports the Financial Times.

Authored by: Trend Intelligence, London