October 5th 2024 – The price of the US Dollar weighted against a basket of other currencies in the well known DXY Index continues to exhibit a negative medium-term trend reports Trend Intelligence, as the index continues to trend some 10% down from its September 2022 highs of $114 to now just $102.

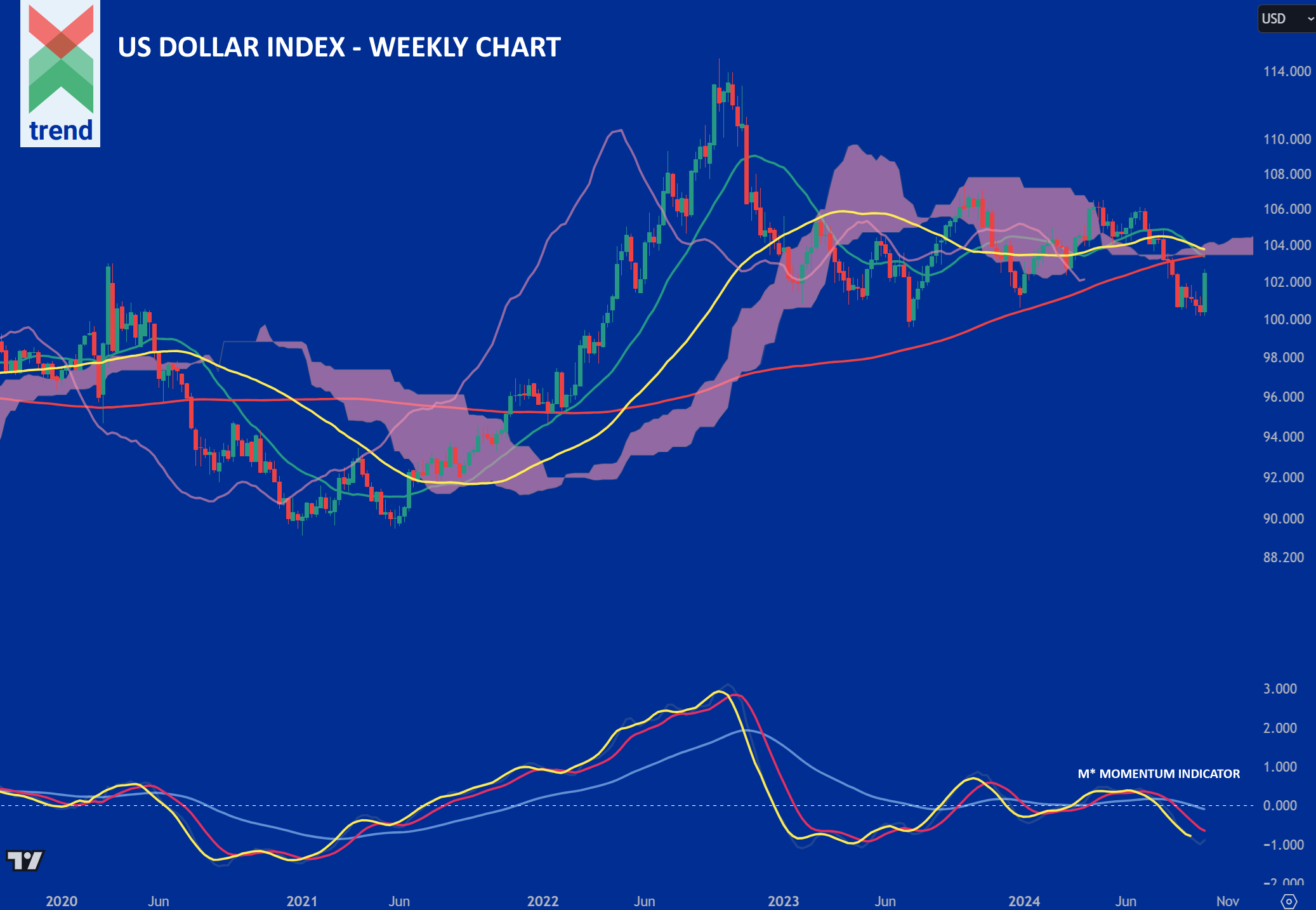

Trend’s Analysis (click chart to expand): In our DXY Index chart, Trend Intelligence uses its M* Momentum Indicator to report a negatively trending M* line, below both Trend’s Signal Line 1 and Signal Line 2. In addition, all indicators are trending below the critical zero line. This is, and has shown over time to be, a negative trend signal.

In addition to our M* indicator, price currently trades below all 3 of Trend’s moving averages and below our Japanese Cloud indicator, shaded in pink.

The combination of all signals corroborates Trend’s negative medium-term trend rating on the index, as we project negative US Dollar index moves in the future weeks and months ahead.

Downside Sentiment: The US dollar is sensitive to interest rate expectations and the general health of the US economy. It has slumped as US data has cemented bets that the Fed will continue to cut rates since its first reduction in September. The dollar is also pricing in an economic slowdown, and has been subject to strengthening foreign currencies like the Japanese Yen, reports the Financial Times.

Upside Sentiment: Then there’s the US election. It’s a potential risk factor thats outcome could result in more fiscal spending or higher international tariffs. Both events a could push the dollar out of its recent negative activity in the short-term, reports Goldman Sachs.

Authored by: Trend Intelligence, London