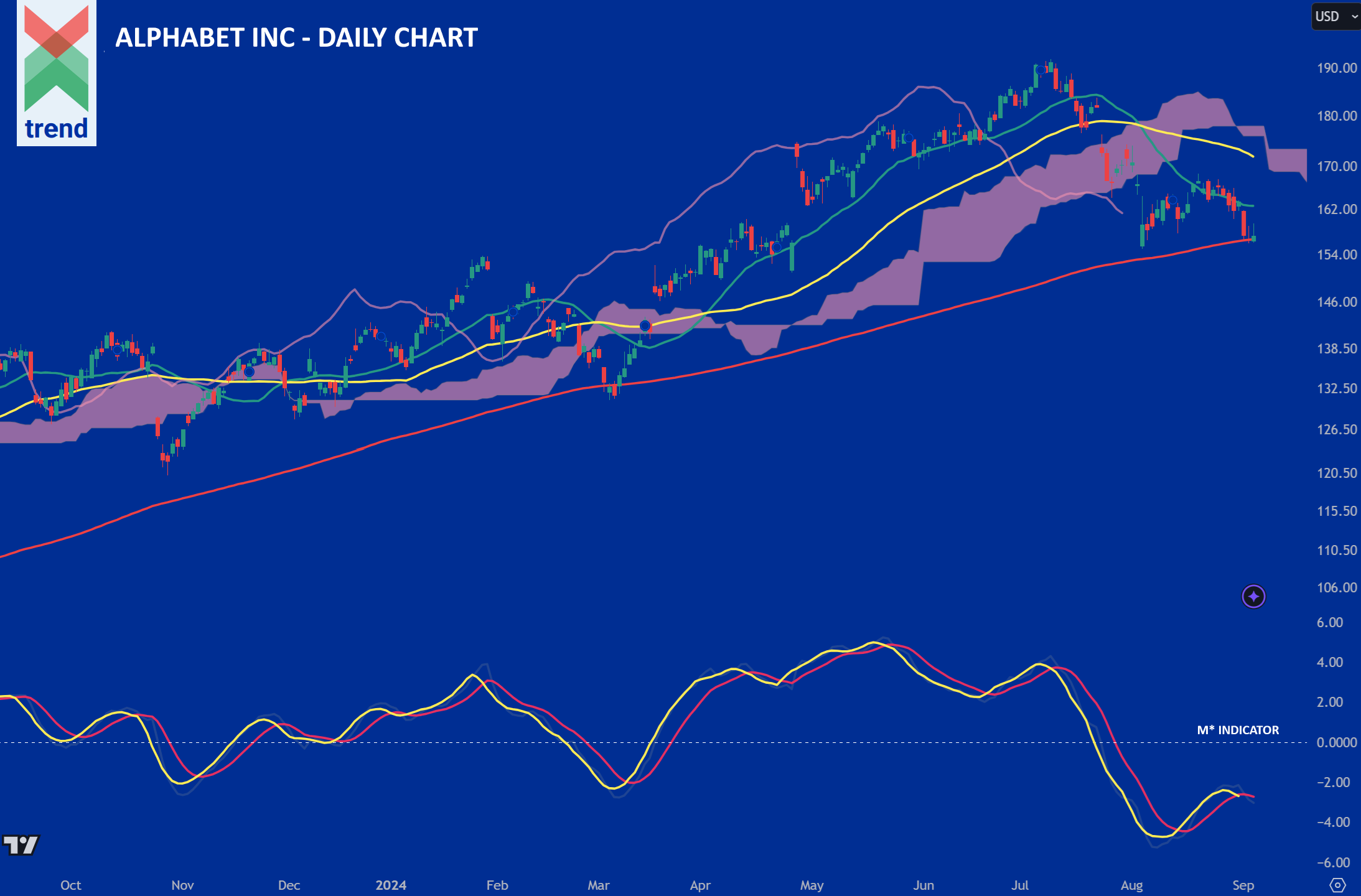

September 6th 2024 – The price of Alphabet Inc continues to exhibit a negative short-term trend reports Trend Intelligence, as the US tech giant’s stock has been falling from its high of $190 in July to now below $160.

Trend’s Analysis (click chart to expand): In our Alphabet Inc chart, Trend Intelligence uses its M* Momentum Indicator to report negatively trending M* and M* Signal lines, with both indications operating below their critical zero line. This is, and has shown over time to be, a negative trend signal.

In addition to the M* indicator, price currently trades below 2 of Trend’s moving averages and below our Japanese Cloud indicator, shaded in pink.

The combination of these signals corroborates Trend’s negative short-term trend rating on the stock, as we project negative price moves in the future weeks ahead.

Downside Sentiment: Today the UK’s Competition and Markets Authority said that its own investigation has found that Google is using anti-competitive practices in advertising tech, harming thousands of UK publishers and advertisers by overcharging them, as well as suppressing any potential competitors, reports the Financial Times.

Upside Sentiment: In July, Alphabet’s revenues jumped 14 per cent in the second quarter, with double-digit growth in advertising. Even stronger growth in its cloud computing business demonstrated high demand for computing and data services, as Big Tech companies race to build large language models and integrate AI into their businesses, reports the Financial Times.

Authored by: Trend Intelligence, London