March 25th 2024 – Today Boeing chief executive Dave Calhoun announced that he will step down at the end of 2024; taking ownership of the ever-building safety concerns being raised across Boeing’s fleet of aircraft. In response, Trend Intelligence now reports that the price of The Boeing Company maintains, and will continue to exhibit, a negative short-term trend as price action settled on Monday 25th March at just over $191.

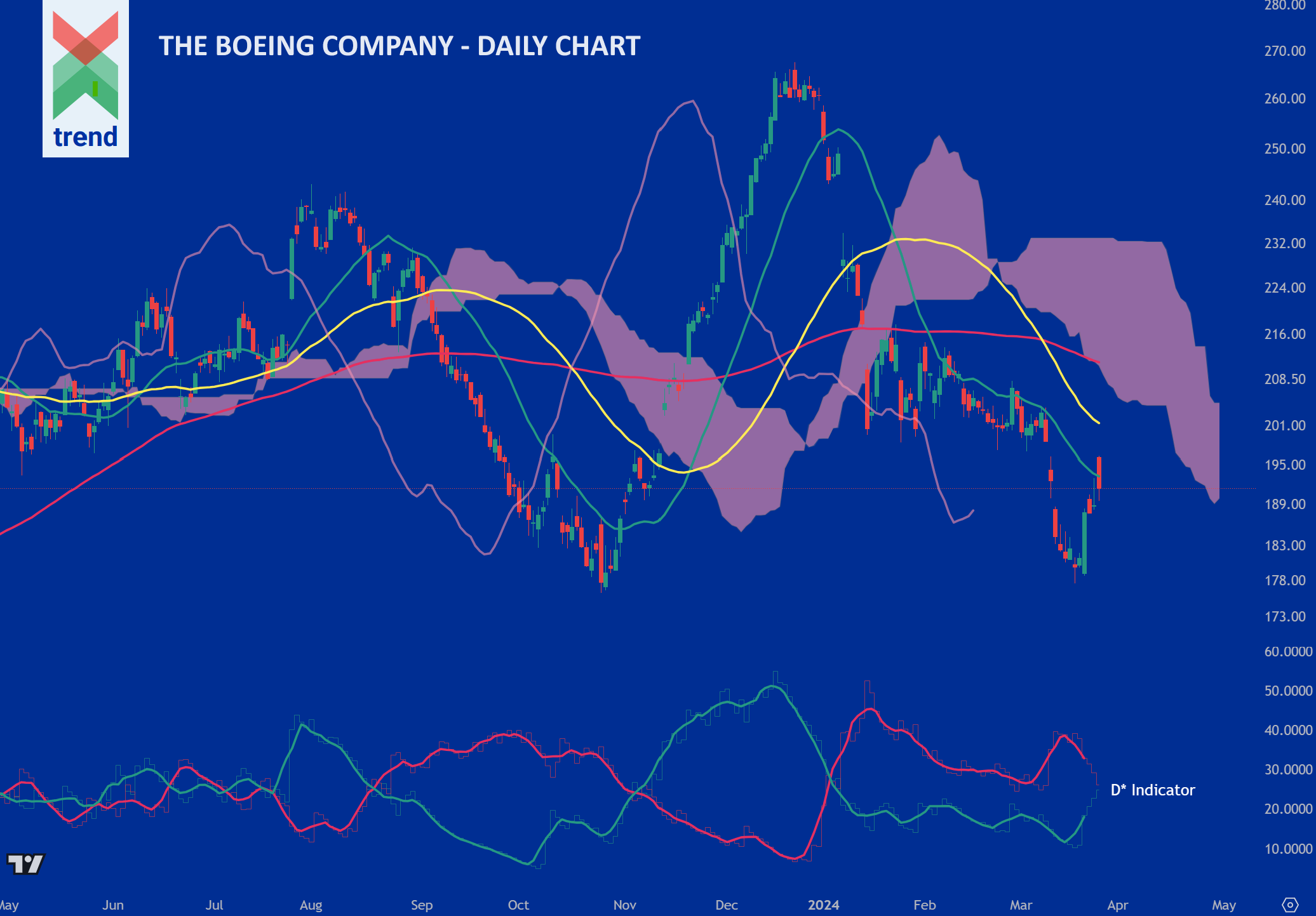

Trend’s Analysis (click chart to expand): Trend’s D* Momentum Indicator creates a clear visual representation of price trends in play across asset classes and financial instruments. In Boeing’s chart, Trend Intelligence reports its red (-D*) line exceeding (and diverting away from) its green (+D*) line. This is, and has shown over time to be, a negative trend signal.

In addition to this indicator, price currently trades below 2 of Trend’s moving averages and below Trend’s Japanese cloud, in pink shading. The indicated pink Delay Line is also below the Japanese Cloud.

The combination of all stated indicators corroborate Trend’s negative short-term trend rating on the stock, looking negative for the future weeks ahead.

Downside Sentiment: Boeing had been forced to reduce its production of the 737 max, causing delays to global deliveries. Last week the company announced that it will burn even more cash in Q1 because of the various crises within Boeing’s aircraft safety, reports the Financial Times.

Upside Sentiment: Today’s shake up at the top with the loss of CEO Dave Calhoun and Larry Kellner from the Board is seen as positive by many investors and business stakeholders, who were losing faith in the company. Ryanair’s CEO Michael O’Leary welcomed today’s organisational changes as a step to eliminate delivery delays, reports the Financial Times.

Authored by: Trend Intelligence, London