May 22nd 2024 – The pricing of the British Pound in relation to the US Dollar is now exhibiting a significant positive short-term trend reports Trend Intelligence, as the pound has risen around 20% from its September 2022 low 0f $1.03 and now trades at just over $1.27.

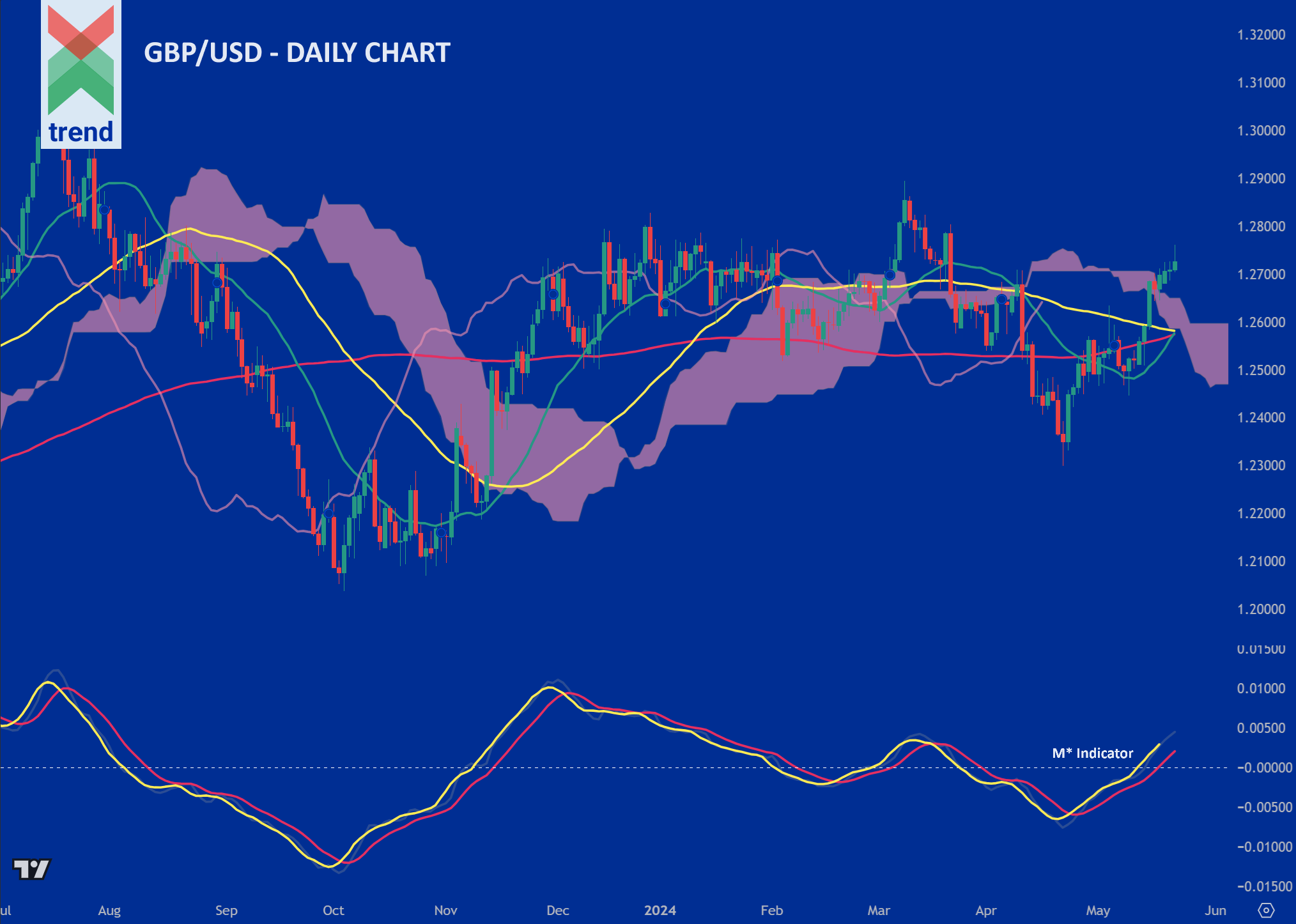

Trend’s Analysis (click chart to expand): Trend’s M* Momentum Indicator creates a clear visual representation of price trends in play across asset classes and financial instruments. In our GBP/USD chart, Trend Intelligence reports positively trending M* and M* Signal lines, with both indicators now trending up above the critical zero line. This is, and has shown over time to be, a positive trend signal.

In addition to the M* indicator, price currently trades above all 3 of Trend’s moving averages and above our Japanese Cloud indicator, in pink shading.

The combination of these signals corroborates Trend’s positive short-term trend rating on the British Pound looking positive for the future weeks ahead.

Downside Sentiment: The Bank of England will next set interest rates on 20 June, and will see May’s inflation figures only one day before. Any surprise price weakness on inflation will reduce the appeal of the British Pound reports IG Bank.

Upside Sentiment: In March, Bloomberg reported that the British pound is beating more than 90% of the world’s currencies this year on signs the nation’s economy is holding up better than expected, keeping interest rates higher for longer.

Authored by: Trend Intelligence, London