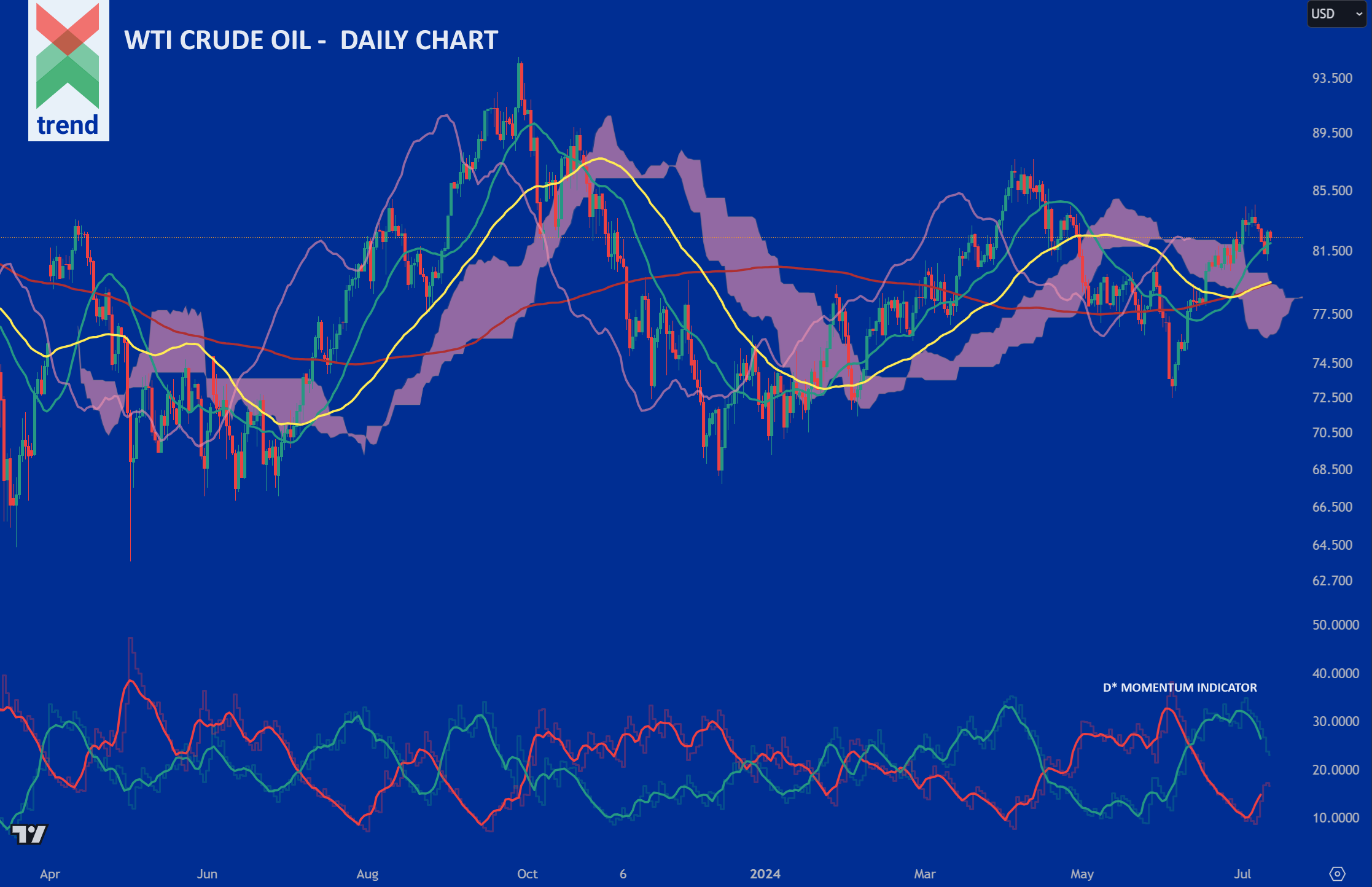

July 11th 2024 – The price of West Texas Intermediate crude oil maintains a positive short-term trend reports Trend Intelligence as price action settled on Tuesday 10th July at just over $82 a barrel.

Trend’s Analysis (click chart to expand): Trend’s D* Momentum Indicator creates a clear visual representation of price trends in play across asset classes and financial instruments. In our WTI crude oil chart, Trend Intelligence reports its positive green (+D*) line exceeding (and diverting away from) its negative red (-D*) line. This is, and has shown over time to be, a positive trend signal.

In addition to Trend’s D* indicator, price currently trades above all 3 of Trend’s moving averages and above Trend’s Japanese cloud, in pink shading.

The combination of all stated indicators corroborate Trend’s positive short-term trend rating on oil, looking positive for the future days and weeks ahead.

Upside Sentiment: The news comes as BP raised its forecast for oil demand by 5% into 2035 as they expect the transition to clean energy to slow, according to the Financial Times.

Downside Sentiment: China features so prominently in all oil demand forecasts as its daily crude imports alone exceeds what the European Union consumes on a daily basis. Earlier in July, Bloomberg cited a slower-than-expected restart of Chinese refineries after their maintenance season and lower purchases by major suppliers, leading to the possibility of a monthly decline in Chinese imports, reports OilPrice.Com.

Authored by: Trend Intelligence, London