February 16th 2025 – Apple’s main manufacturing partner, Foxconn Technology (based in Taiwan) is under increasing pressure from the Chinese state to limit the technology and intellectual property that leaves the region in favour of India (Apple’s new favourite offshore location to build its supply chain). China has now begun safeguarding its leading technologies as reciprocal tariffs ensue from US President Donald Trump, along with a trade row with Europe over car imports.

Trend’s Analysis (click chart to expand): Trend Intelligence uses a customized collection of trend-following signals, expressed in aggregate as a Trend Score, to demonstrate ongoing price trends across financial market indices and instruments.

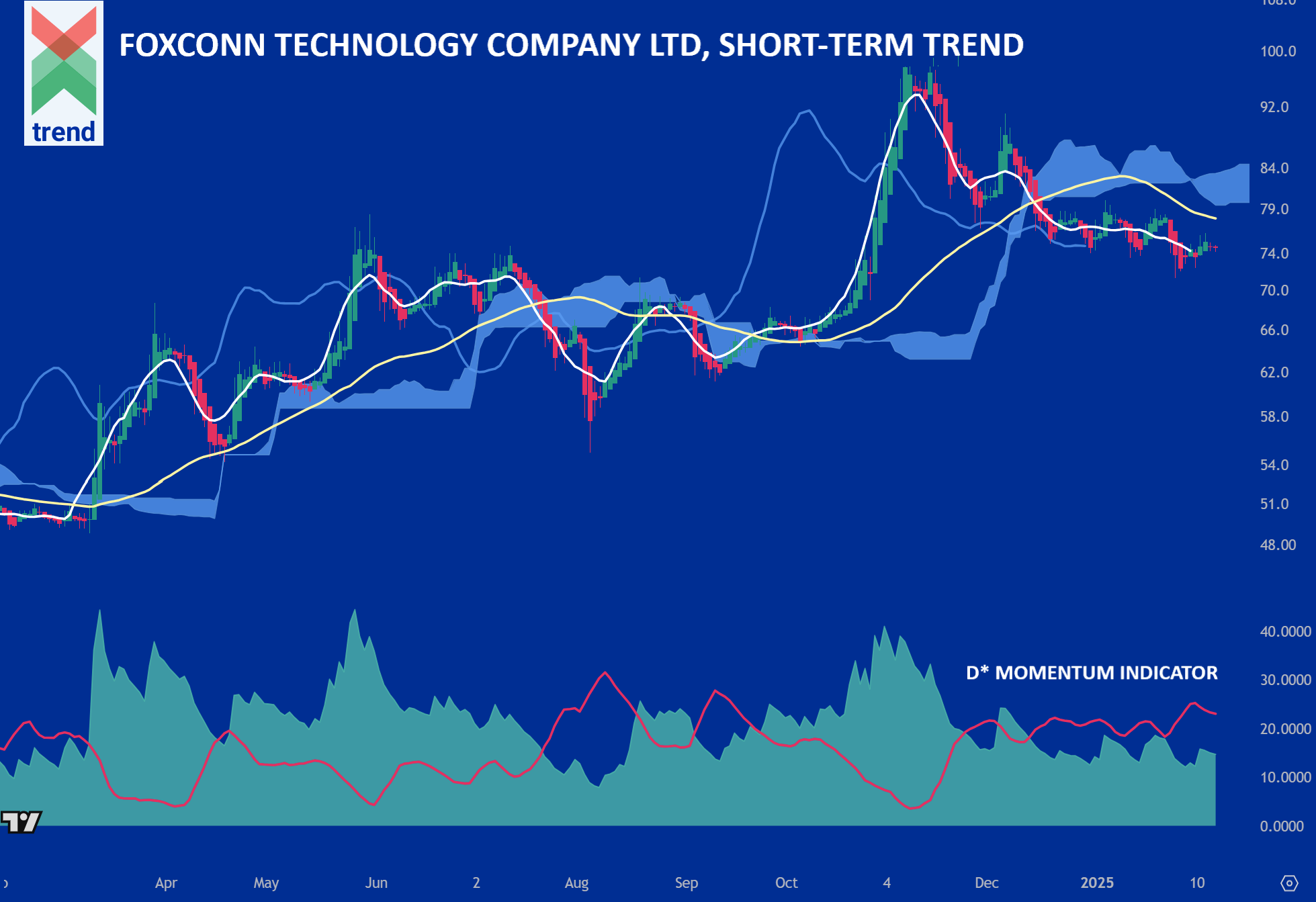

In our Foxconn chart, Trend Intelligence uses its D* Momentum Indicator to highlight its red (-D* Line) operating above the green (+D* Area). This is, and has shown over time to be, a negative trend signal.

In addition to our D* Momentum Indicator, Foxconn’s share price currently trades below Trend’s medium-term (yellow) moving average and the Japanese Cloud indicator, shaded in blue. With respect to all indicators, Trend Intelligence remains negative on Foxconn Technology until the trend shows signs of ending.

Downside News: China’s moves to limit Foxconn’s technology abroad may damage Foxconn’s ability to meet demand in the short-term and subsequently its earnings, reports The Financial Times.

Upside News: Last week Foxconn confirmed that it will consider acquiring Renault’s stake in Nissan if a condition is made for working on electric vehicles. The news comes as part of the company’s strategy involves manufacturing EVs for car companies to sell under their own brand, reports The Financial Times.

Authored by Trend Intelligence, London