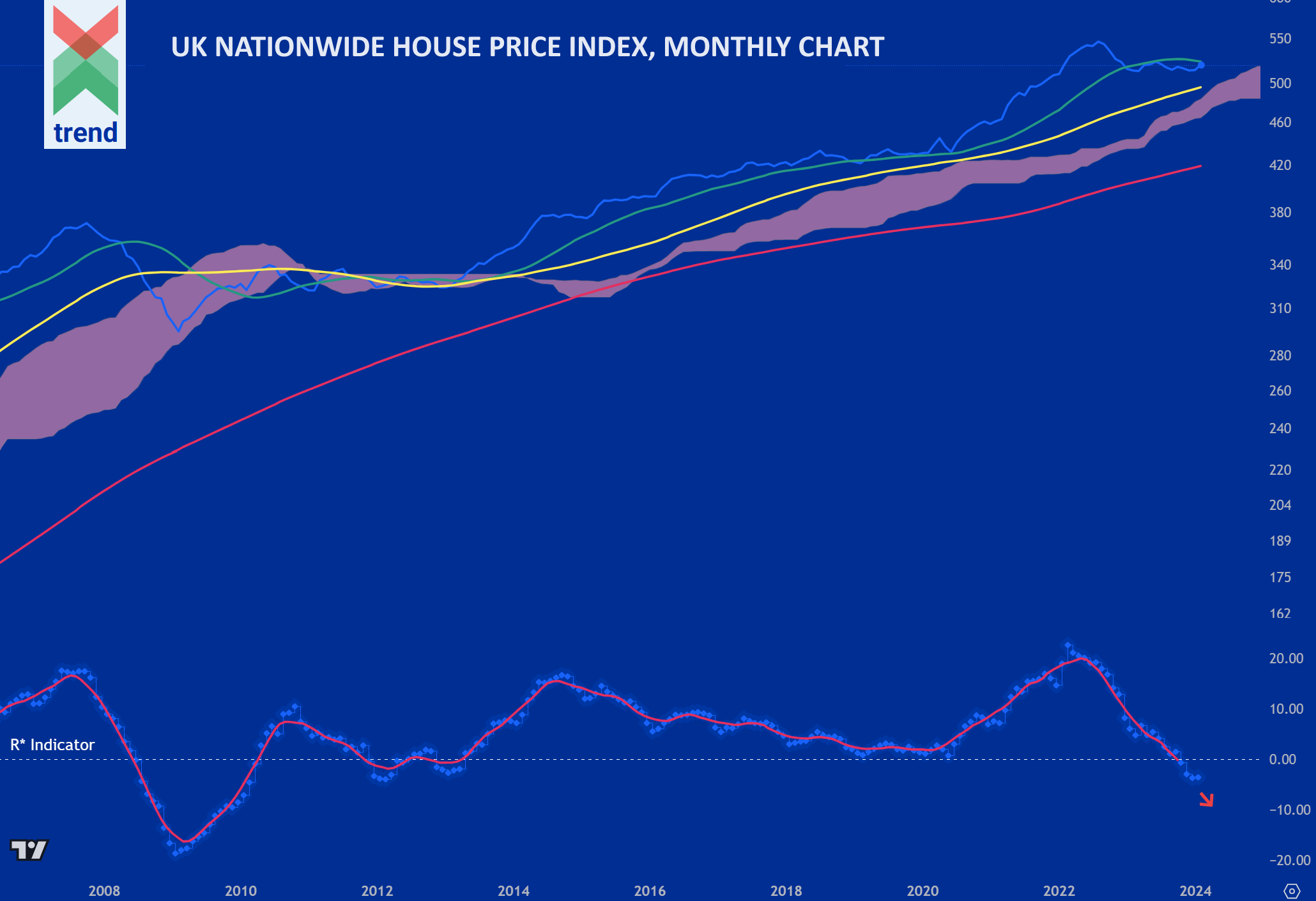

March 16th 2024 – The price of UK houses as measured by Nationwide’s House Price Index are exhibiting, and developing further into, a neutral/negative long-term trend reports Trend Intelligence, with the index settling at 519.51 in February 2024.

Nationwide’s House Price Index is derived from Nationwide’s lending for owner-occupier houses. As one of the UK’s biggest mortgage providers their price data stretches all the way back to 1952. Trend looks at index data going back to 2007.

Trend’s Analysis (click chart to expand): Trend’s R* Momentum Indicator and its red Signal Line are reading another negative (and downwards sloping) month, an expression of negative prices ahead, with similar signals historically being shown in the beginning of 2008. In addition to this, index price action currently trades below Trend’s short-term (green) moving average. Positively, price still remains above Trend’s medium and long- term moving averages and Trend’s Japanese Cloud, in pink shading.

The stated negative R* indicator readings and the short-term moving average price break, corroborates Trend’s neutral/negative long-term trend rating on UK house prices for many months ahead.

Downside Sentiment: House prices are hit harder by rate rises when interest rates start from a low level, and that a recession inevitably makes everything worse, reports Bloomberg.

Upside Sentiment: UK estate agents are at their most optimistic about near-term growth in house prices in almost two years, according to a RICS survey published in March, reports the Financial Times.

Authored by: Trend Intelligence, London