March 2nd 2025 – The UK’s Lloyds Banking Group is newly in line to receive the revenue benefit of providing banking services to hundreds of UK government organisations via HM Revenue & Customs, reports the Financial Times. The bank will Join Citigroup and Natwest Group in providing services to the UK government expected to be worth £344 million over the next 12 years.

Trend’s Analysis (click chart to expand): Trend Intelligence uses a customized collection of trend-following signals, expressed in aggregate as a Trend Score, to demonstrate ongoing price trends across financial market indices and instruments.

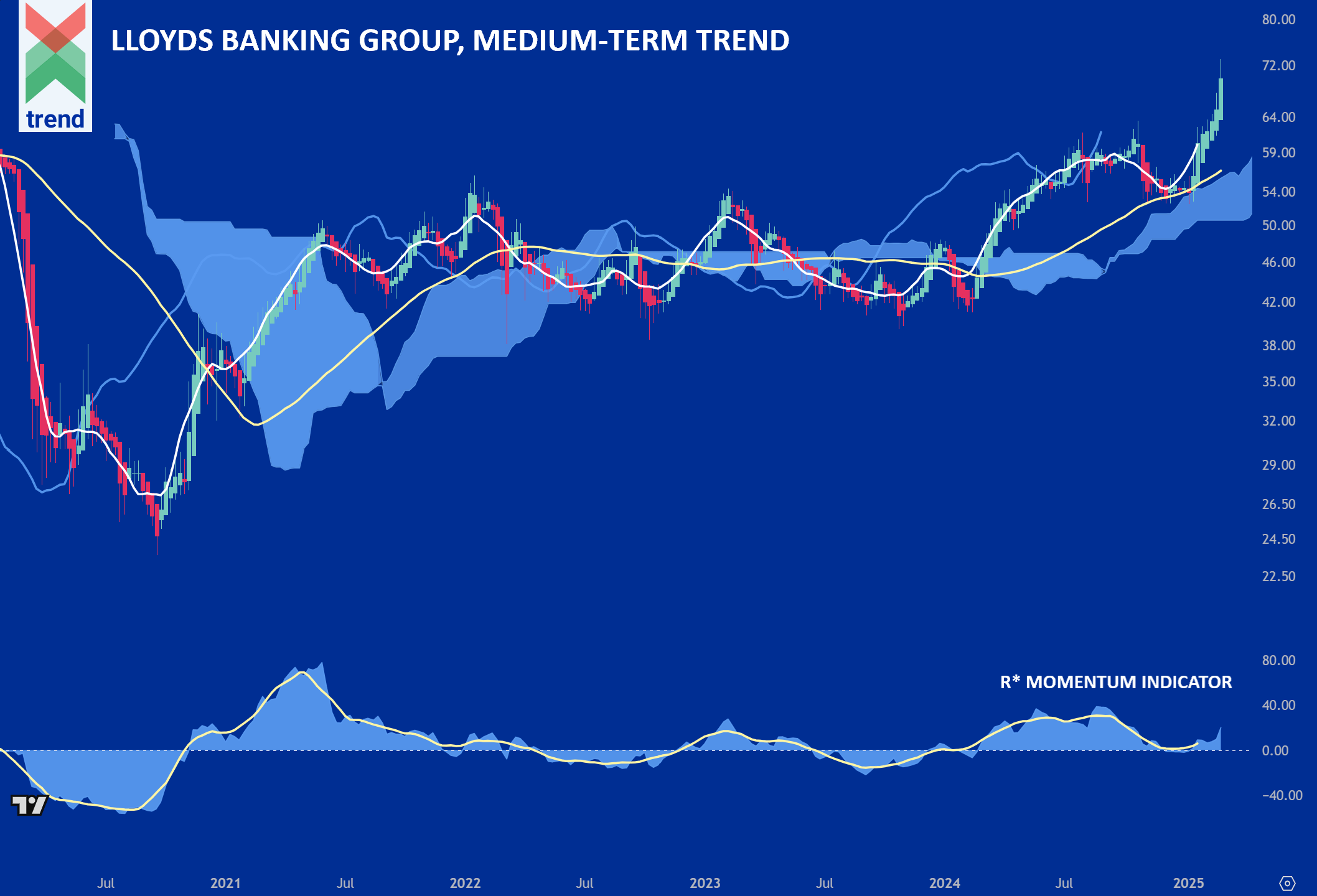

In our Lloyds Banking chart, Trend Intelligence uses its R* Momentum Indicator to indicate that its R* Area (blue) and R* Signal Line (yellow) are trading above the zero (horizontal) cutoff line. This is, and has shown over time to be, a positive trend signal.

In addition to Trend’s R* Momentum Indicator, Lloyds share price currently prices far above Trend’s medium-term (yellow) moving average and Japanese Cloud indicator (shaded in blue). With respect to all indicators, Trend Intelligence remains strongly positive on Lloyds Banking Group’s share price until the trend shows signs of ending.

Downside News: As one of the largest car finance providers in the UK, Lloyds recently warned of continued uncertainty following an ongoing regulatory inquiry that it faces. Lloyds has now set aside a total of 1.15 billion pounds following the investigation into its historic mis-selling of motor finance, according to Reuters News.

Upside News: Brokers have raised their price targets for Lloyds in 2025 – the more recent range suggests that shares could gain between 9% and 17% this year. Deutsche Bank has pinned an 80 pence price target on the shares for this year, according to Yahoo Finance.

- View Trend’s full report on Lloyds Banking Group here

Authored by Trend Intelligence, London