June 23rd 2025 – The US bombing of Iranian nuclear sites over the weekend is pushing WTI crude oil prices further into an aggressive positive trend, reports Trend Intelligence. The news comes as President Donald Trump threatened the possibility of continuing strikes against Iran and regime change should the Iranian military strike back against US targets in the Middle East, reports the Financial Times.

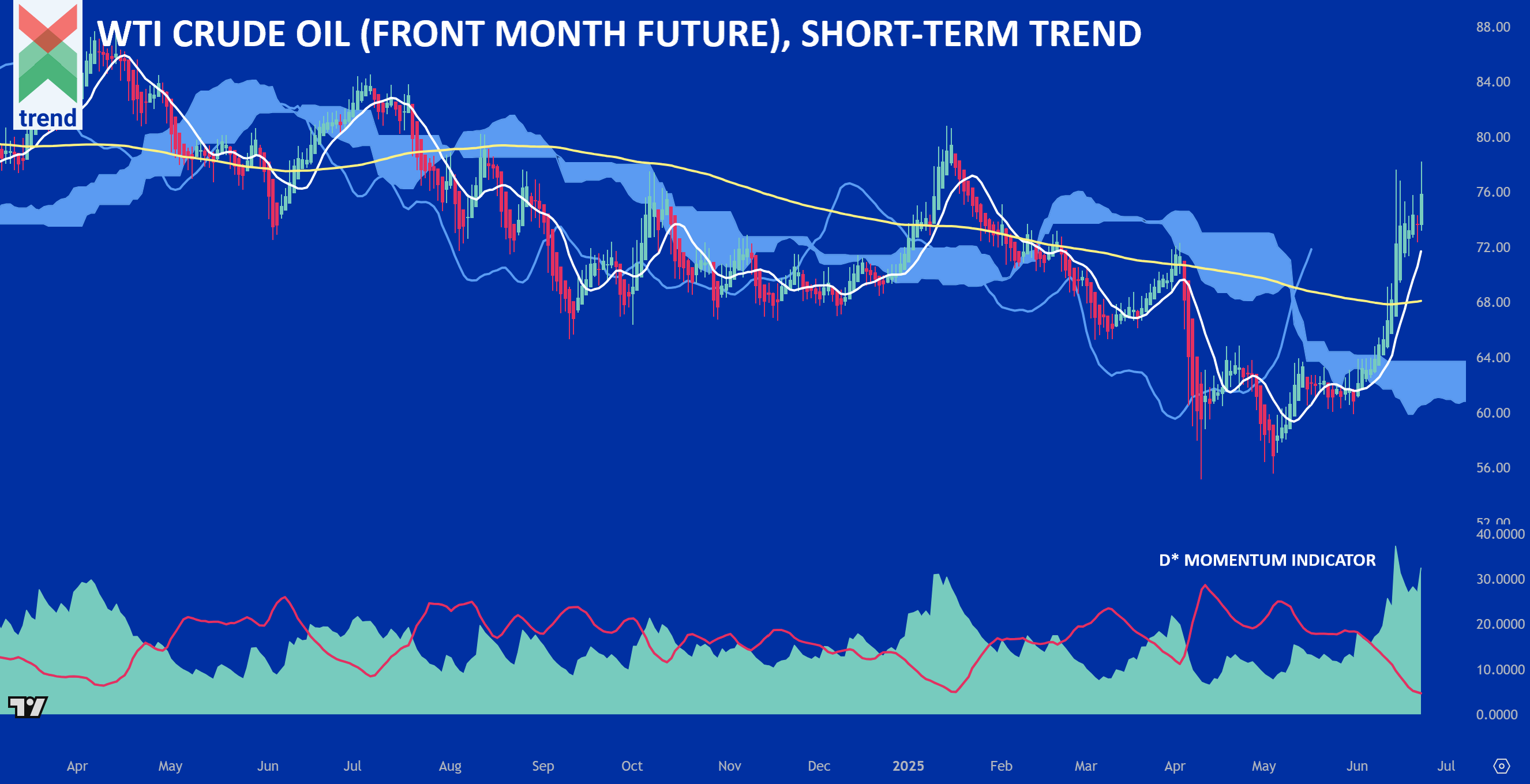

Trend’s Analysis (click chart to expand): Trend Intelligence uses a customized collection of trend-following signals, expressed in aggregate as a Trend Score, to demonstrate ongoing price trends across financial market instruments and indices.

In our crude oil chart, Trend Intelligence uses its D* Momentum Indicator to highlight its red (-D* Line) operating far below the green (+D* Area). This is, and has shown over time to be, a positive trend signal.

In addition to our D* Momentum Indicator, crude oil continues to trade far above Trend’s medium-term (yellow) moving average and our Japanese Cloud indicator, shaded in blue. With respect to all signals, Trend Intelligence remains positive on crude oil prices until the trend shows signs of ending.

Upside News: The Iranian Parliament on Sunday approved a measure to close the Strait of Hormuz after the United States bombed Iran. The Strait of Hormuz’s width and depth allow it to handle the world’s largest crude oil tankers. Approximately 20 million barrels (20 percent) of global oil trade flowed through the strait in 2024, reports The Hill. Adding further pressure to prices, US oil supply (the largest contributor to non-OPEC supply) is now expected to grow at a slower pace as US production scales back on spending, reports the IEA.

Downside News: Several hours ago the US Secretary of State Marco Rubio called on China to prevent Iran from closing the Strait of Hormuz. With most oil traffic leaving the strait being directed towards Asia, China in particular (the world’s largest buyer of Iranian oil) has an interest in keeping it open, reports the BBC.

Authored by Trend Intelligence, London