February 3rd 2025 – Donald Trump and Justin Trudeau have exchanged blows over the weekend as respective tariffs have been placed on both US and Canadian exported goods. Donald Trump’s unwillingness to compromise with Canada (and Mexico) has sent waves through financial markets, as the fear that more (uncompromising) tariffs are set to be levied on European exports to the United States. In response to this weekend’s news, Trend Intelligence takes a look at the major Canadian stock indices as well as the Canadian Dollar. Trend Intelligence uses a customized collection of trend-following signals, expressed in aggregate as a Trend Score, to demonstrate ongoing price trends across financial market indices and instruments.

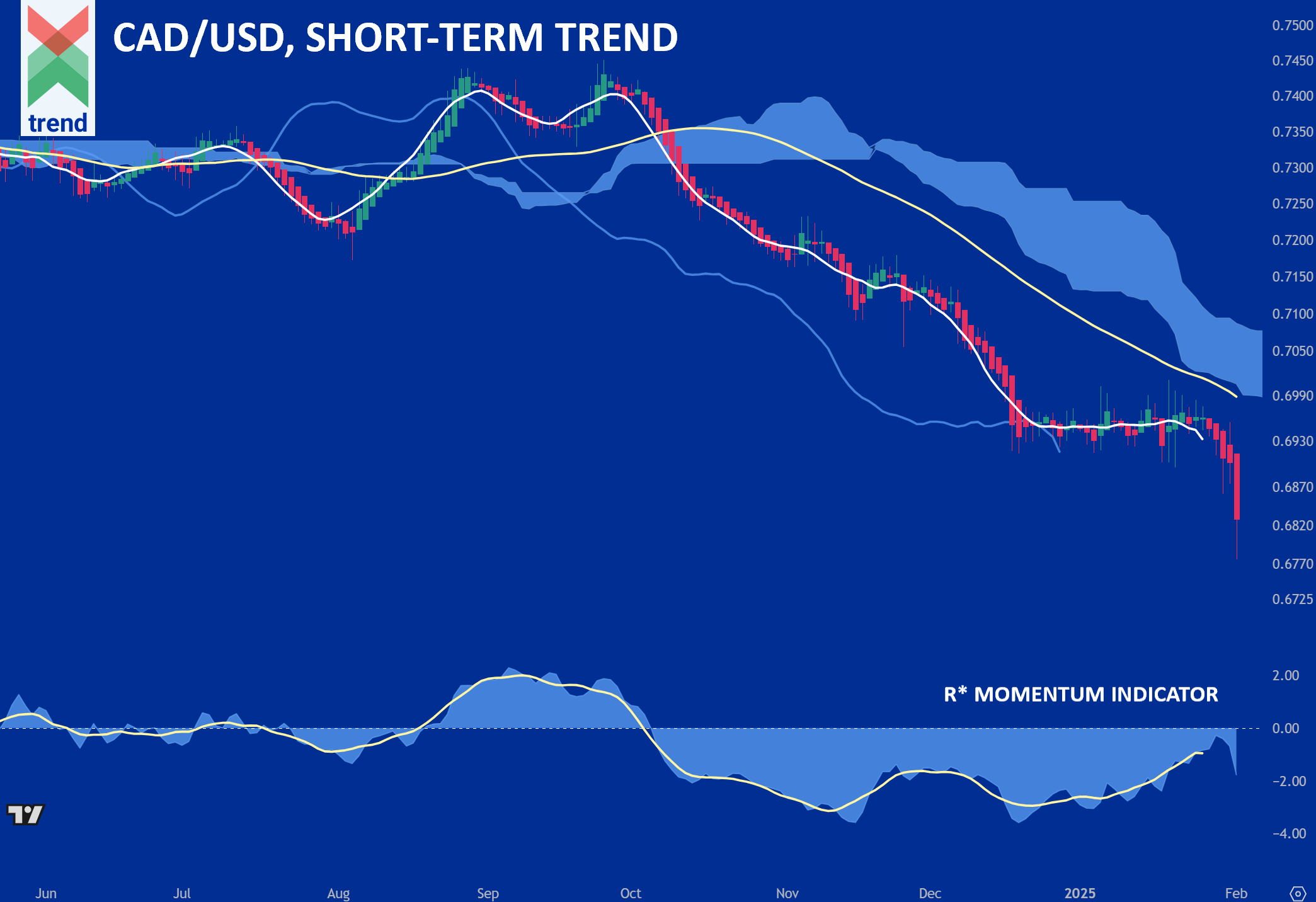

Trend’s Analysis (click chart to expand): In our CAD/USD chart, Trend Intelligence uses its R* Momentum Indicator to demonstrate a negative trending R* area and yellow Signal Line. This is, and has shown over time to be, a negative trend signal.

In addition to our R* indicator, the Canadian Dollar’s price against USD currently trades below Trend’s medium-term (yellow) moving average and the Japanese Cloud indicator, shaded in blue. As such, Trend Intelligence remains negative on CAD/USD until the trend shows signs of ending.

Similar negative signals are apparent on the S&P/TSX Small Cap Index as smaller companies are expected to be harder hit by US tariffs. Trend Intelligence projects continued downward moves in this index until the trend shows signs of reversing.

Downside News: Donald Trump is now facing backlash from business groups and some in the Republican party. US Trade associations representing consumer goods, oil, groceries and automakers are warning that the tariffs will lead to significant inflation. In Canada, economists and business leaders fear that these tariffs will lead to significant unemployment, and cause a shock to both the US and Canadian economies reports The Financial Times.

Upside News: The Canadian dollar has already weakened by 7% in the past 12 months. Any additional weakness in the Canadian dollar will buffer the price shock for Americans and reduce the expected drop in demand for Canadian tariffed goods. Canadian raw commodity exports are also less likely to see a drop in U.S. demand as Americans lack substitutes for these goods, reports RBC Economics.

Authored by Trend Intelligence, London