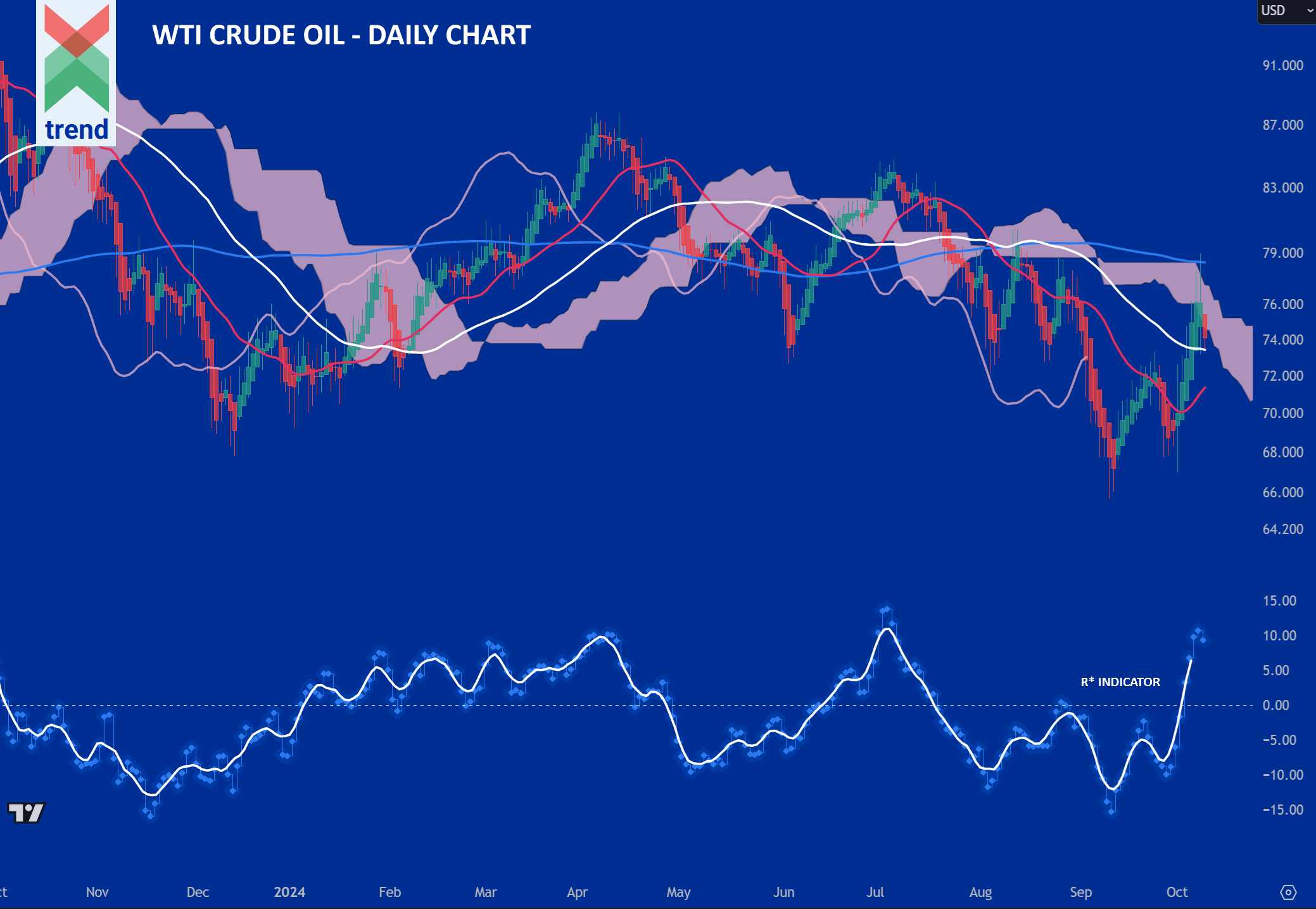

9th October 2024 – The price of spot WTI crude oil is beginning to exhibit an aggressive positive short-term trend reports Trend Intelligence, as its price currently sits some 11% higher than its September 2024 low of around $65 a barrel.

Trend’s Analysis (click chart to expand): Trend’s R* Momentum Indicator and its white signal line create a clear visual representation of price trends in play across asset classes and financial instruments. In our oil chart, Trend Intelligence reports aggressively positive trending R* and white signal lines, with both indicators operating sharply above the critical zero line. This is, and has shown over time to be, a positive trend signal. In addition to the R* indicator, price currently trades well above 2 of Trend’s moving averages.

The combination of these signals corroborates Trend’s positive short-term trend rating on WTI, with the price looking positive in the days and weeks ahead.

Downside Sentiment: Trend’s recent medium term analysis on crude oil shows that the commodity still remains negative in the longer term time frames, needing to make considerable and sustained positive gains in the short-term to show positive trend signals in the medium-term. Additionally, this week BP abandoned its planned 2030 oil and gas output cuts, reports Reuters News.

Upside Sentiment: Hurricane Milton making landfall has shut refining terminals and pipelines in Florida reports S&P Global which could add further increases to oil in the short term. The anticipated Israeli strike on Iran is also expected to add upwards pressure to oil prices reports Forbes.

Authored by: Trend Intelligence, London