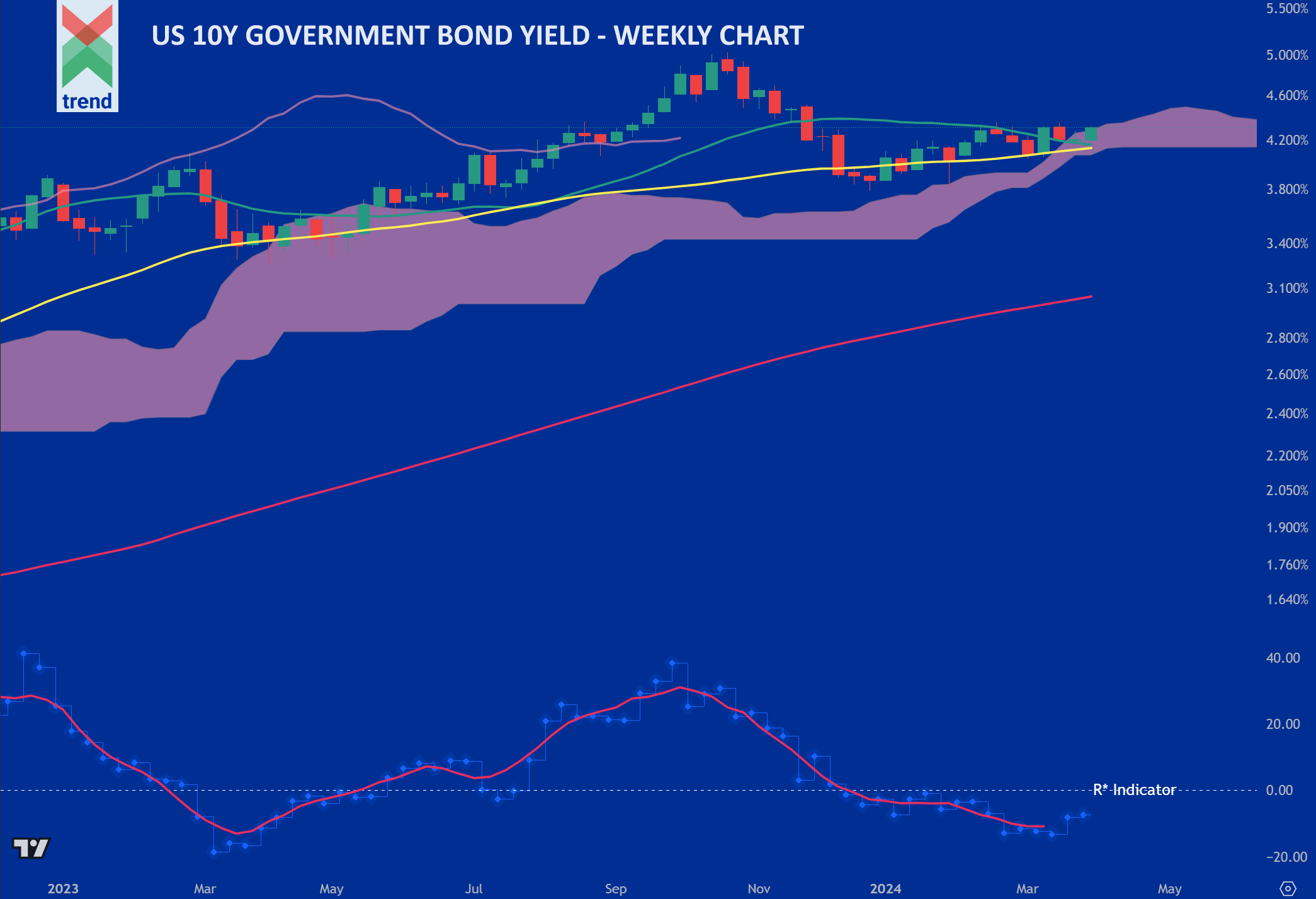

April 1st 2024 – The yield on the US Government’s 10 year bond is expected to develop further into a negative medium-term trend reports Trend Intelligence, with the instruments settling at 4.194% on the last trading day of March.

Trend’s Analysis (click chart to expand): Trend’s R* Momentum Indicator and its red signal line currently both read below zero – indicating that a negative trend in the bond yield is underway and will continue until signs of reversal are shown. In addition to these signals, Trend’s short-term (green) moving average looks as if it will soon cross below Trend’s (yellow) medium-term moving average, an additional indication of yield weakness.

The readings corroborate Trend’s negative medium-term trend rating on the 10 Year yield, for weeks and months ahead.

Downside Sentiment: The Federal Reserve has managed to pull down inflation to reading 2.5% in February and chair Jay Powell has said that he still expects inflation to fall towards the US central bank’s 2% goal. The Fed’s latest projections showed that Central Bank officials are still expected to cut interest rates by 0.75% this year, down from their 23-year high of 5.5% reports the Financial Times. Falling inflation and interest rate cuts are attractive for bond investors and push bond yields down. Corporate borrowers have taken advanatge of the falling benchmark bond yields to date and have issued $606bn worth of dollar bonds so far this year, up by two-fifths compared with the same period in 2023, reports the Financial Times.

Upside Sentiment: Increasing energy prices from the escalating wars in Ukraine and in the Middle East could push inflation rates higher in 2024 and force Central Banks to reverse course – either holding their base rates where they currently are or even begin to increase them again. Such action would be disruptive to the global bond market and push their yields higher once more.

Authored by: Trend Intelligence, London