James Harris Simons (April 1938 – May 2024) was an American hedge fund manager, investor, mathematician, and philanthropist. In the 1980’s he founded Renaissance Technologies, which was one of the first quantitative hedge funds. Simons was a pioneer in the field of quantitative finance and his net worth was estimated to be $31.4 billion, the 51st-richest person in the world.

Early Life

Jim Simons received a bachelor’s degree in mathematics from MIT in 1958 and started his career as an academic in Mathematics – in which he won numerous awards. In 1964, Simons began working with the National Security Agency as a cold-war code breaker. Simons later taught mathematics at the Massachusetts Institute of Technology and at Harvard University.

Renaissance Technologies & Trend Following

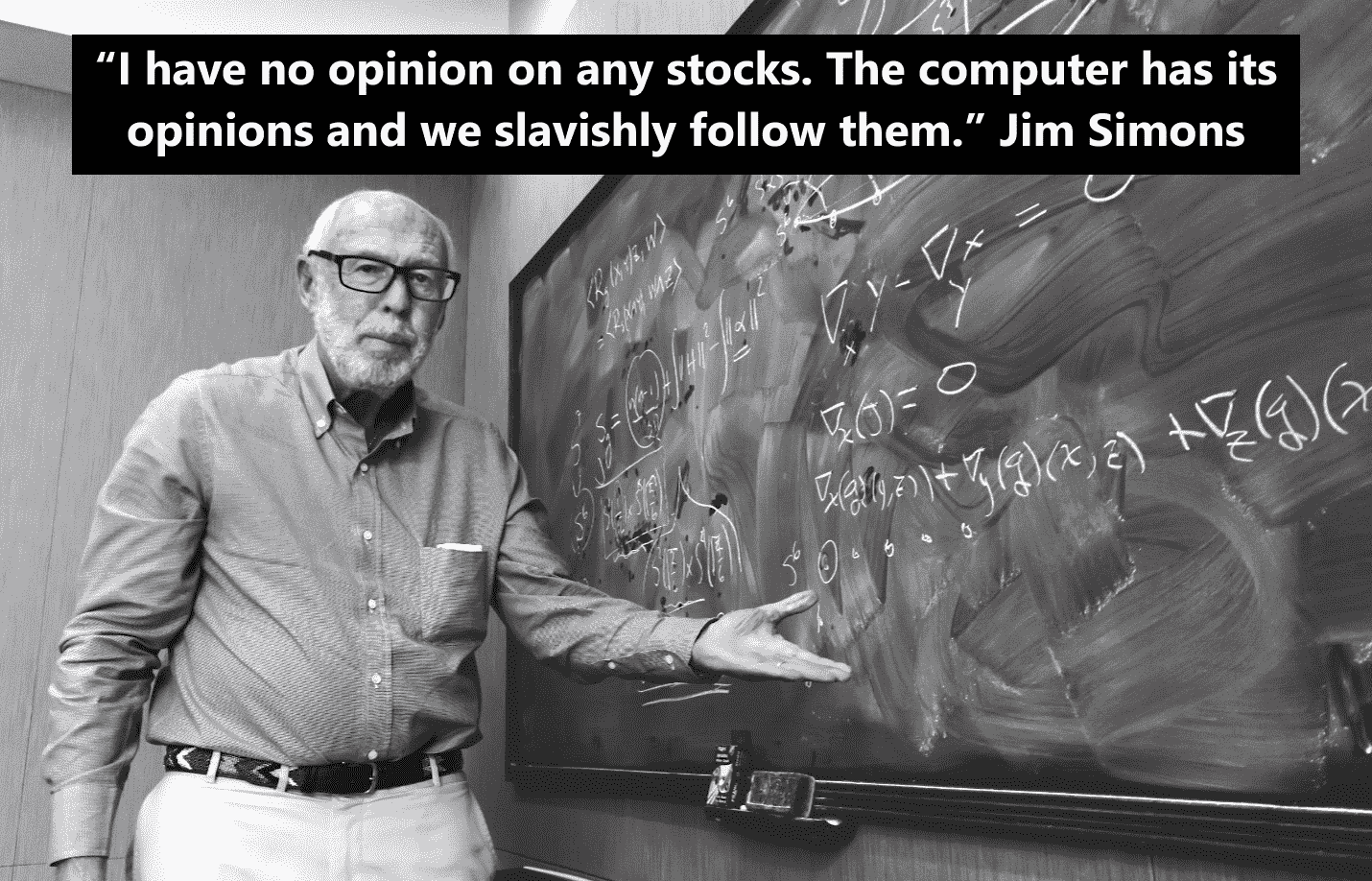

Jim Simons was known as a curious pattern finder and in the 1980’s he launched Renaissance Technologies and its infamous Medallion Fund. Unlike most investors who studied fundamental factors such as sales and earnings, Simons was one of the first to build and rely on automated trading models that took advantage of trading patterns. Many of these patterns were mathematical derivations from the price of the securities that he analysed, becoming “Trend-Following”. The Renaissance Medallion fund was to become one the most successful hedge funds of all time, earning over $100 billion in trading profits up until 2018.

Renaissance Technologies was also one of the first hedge funds to employ analysts with non-traditional backgrounds, including mathematicians, physicists and statisticians. Jim’s rationale in hiring this way was that he needed scientifically trained minds that would follow his systematic rules; “The advantage that scientists bring to the table is the scientific method, which attempts to look at a situation objectively and avoid bias” he said.

Following the success of Renaissance and similar 1980’s hedge funds (such as DE Shaw which Jeff Bezos worked for) quantitative strategies that use trend-following models have surged in use accross Wall Street, now accounting for more than 20% of all equity assets, according to a recent estimate from JPMorgan.

Linking Trend Intelligence

Inspired by Jim Simons and Renaissance Technologies, Trend Intelligence statistically researches and visualizes price trends for its clients, using leading trend-following indicators from the field of quantitative finance. Similar to Renaissance, Trend employs objective rules (that calculate a trend-score) helping clients understand the strength and direction of a price trend. Trend’s mission is to bring trend-following models to globally minded corporations, financial institutions and the financial media, so that they can better understand financial markets and make their greatest decisions.

Authored by: Trend Intelligence, London