April 24th 2025 – President Donald Trump is planning to spare US carmakers such as Tesla from the impact of some of his new tariffs, in another trade war climbdown following auto industry lobbying. The expected move would exempt car parts from the tariffs imposed on China, but would keep in place 25% tariffs on all imported Chinese (and foreign) vehicles, reported the Financial Times.

This week, Tesla’s Elon Musk said that he would “significantly” scale back his US government role and refocus his attention to Tesla, after Tesla’s reported net income dropped a huge 71 per cent to $409mn in the first quarter of 2025.

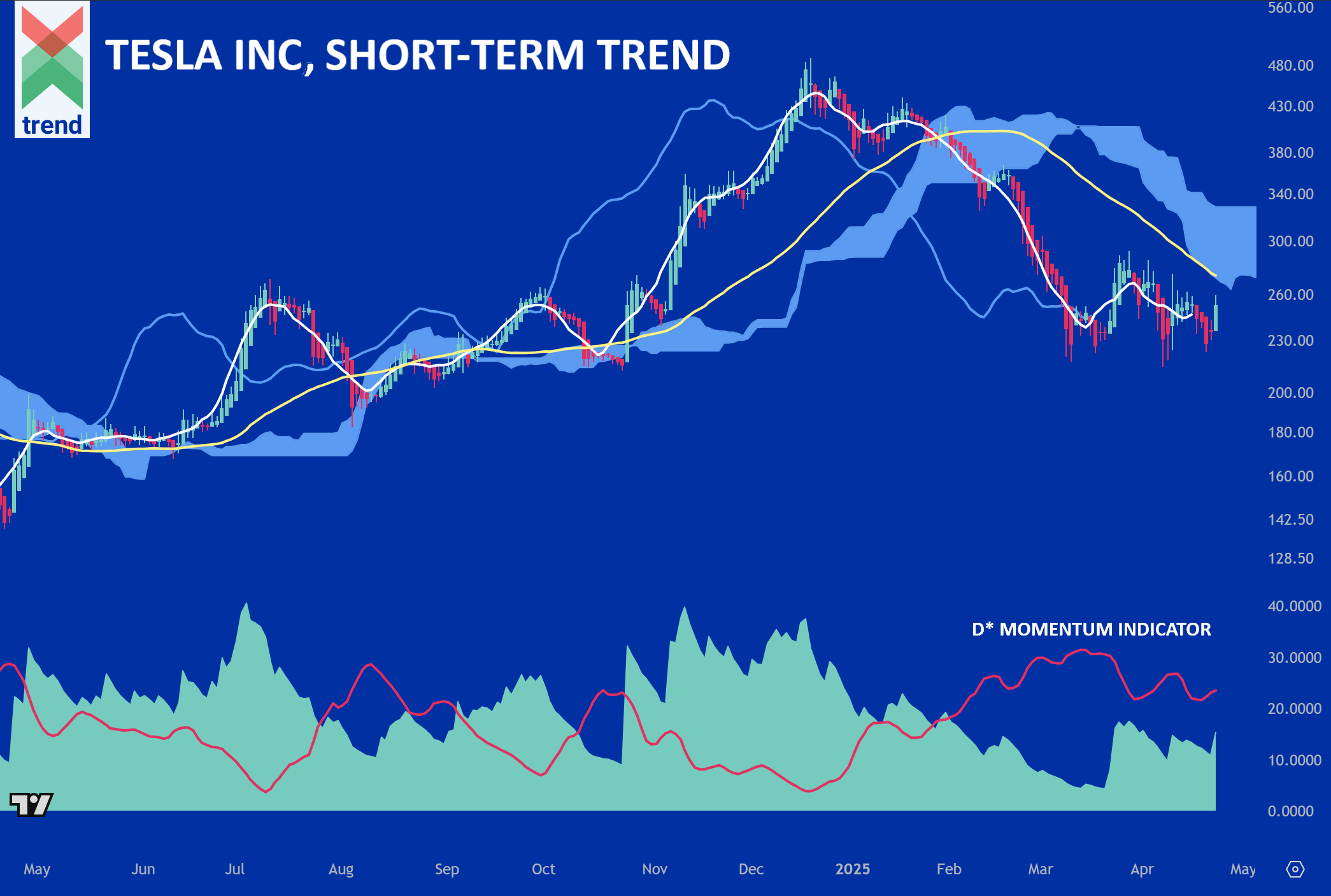

Trend’s Analysis (click chart to expand): Trend Intelligence uses a customized collection of trend-following signals, expressed in aggregate as a Trend Score, to demonstrate ongoing price trends across financial market indices and instruments.

In our Tesla chart, Trend Intelligence uses its D* Momentum Indicator to highlight its red (-D* Line) still operating far above the green (+D* Area). This is, and has shown over time to be, a negative trend signal.

In addition to our D* Momentum Indicator, Tesla continues to trade far below Trend’s medium-term (yellow) moving average and our Japanese Cloud indicator, shaded in blue. With respect to all indicators, Trend Intelligence remains negative on Tesla until the trend shows signs of ending.

Downside News: Tesla assembles all of its vehicles sold in the US locally, but it is still exposed to Trump’s tariffs on imports – such as when importing battery cells from China. Chief Financial Officer Vaibhav Taneja this week warned of an “outsized” impact of the new tariffs, including impacts to Tesla’s parallel energy storage businesses. Tesla is working to holistically find non-Chinese suppliers, but Taneja admitted that “It will take time”, reported the Financial Times.

Upside News: This week, Stifel investment analysts reiterated their Buy rating and their $455 price target for Tesla stock. Analysts at Stifel highlighted several positive aspects from this week’s earnings report, including Elon Musk’s announcement to reduce his time at DOGE and that the company confirmed it’s working towards developing a lower-priced vehicle in the first half of 2025, reported Investing.com.

- Click here to view Trend’s full report on Tesla

- Click here to view Trend’s full report on the S&P 500 Index

Authored by Trend Intelligence, London