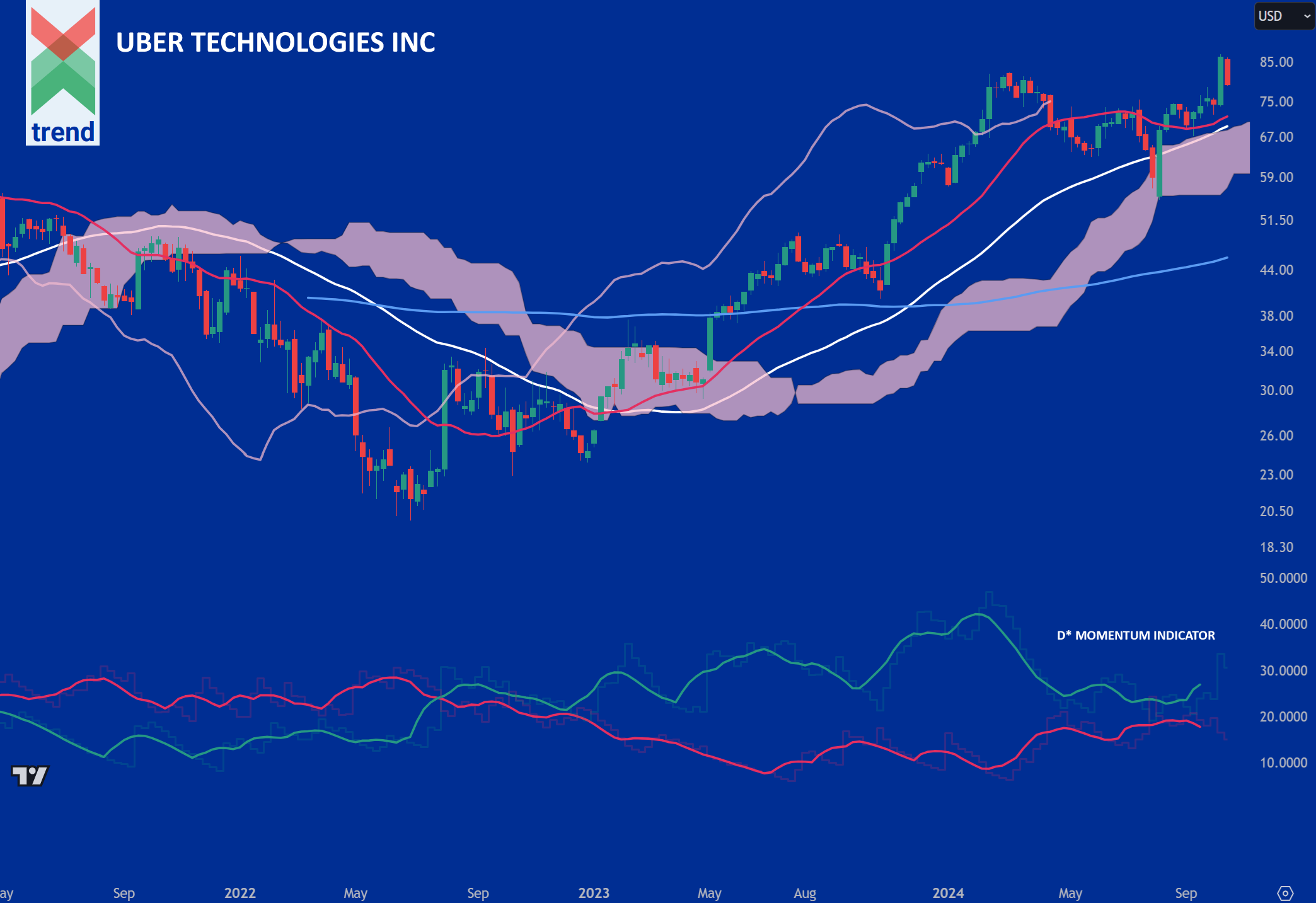

20th October 2024 – The share price of the premier ride hailing and food delivery app Uber Technologies Inc remains in a positive medium-term trend, reports Trend Intelligence, as its price currently sits at $79, up some 43% from its $55 low in the first week of August this year, and up 30% since the start of the 2024.

Trend’s Analysis (click chart to expand): Trend’s D* Momentum Indicator creates a clear visual representation of price trends in play across asset classes and financial instruments. In our Uber chart, Trend Intelligence reports a positive trending +D* Line, still outperforming its lagging -D* Line (since September 2023). This is, and has shown over time to be, a positive trend signal. In addition to the D* Momentum Indicator, price currently trades above all 3 of Trend’s moving averages and our Japanese Cloud indicator.

The combination of these signals corroborates Trend’s positive medium-term trend rating on Uber, with the price looking to continue upwards in the weeks and months ahead.

Upside Sentiment: Trend’s recent full analysis on Uber shows that the stock will continue on its positive path in the medium-term time frame. Recent talks between Uber and Expedia seem to think that the creation of a travel ‘Super App’ could be on the cards, reports the Financial Times.

Downside Sentiment: 2024 is the first year that Uber has turned a profit, but the company is under continual pressure to cease or make fair its algorithmic pricing policies for drivers, and secure their drivers data. Their recent $324M fine from the Dutch Data Protection Authority is one such example, cites Bloomberg.

Authored by: Trend Intelligence, London