December 6th 2024 – The price of UnitedHealth Group continued its second day of aggressive selling following the targeted assassination of its CEO Brian Thompson in New York last week. The gunman is still at large. The 2 day moves are starting to produce a cluster of negative short-term trend signals in UHG’s share price, reports Trend Intelligence, as its current share price of around $550 is down some 13% from its early November all time high of $631.

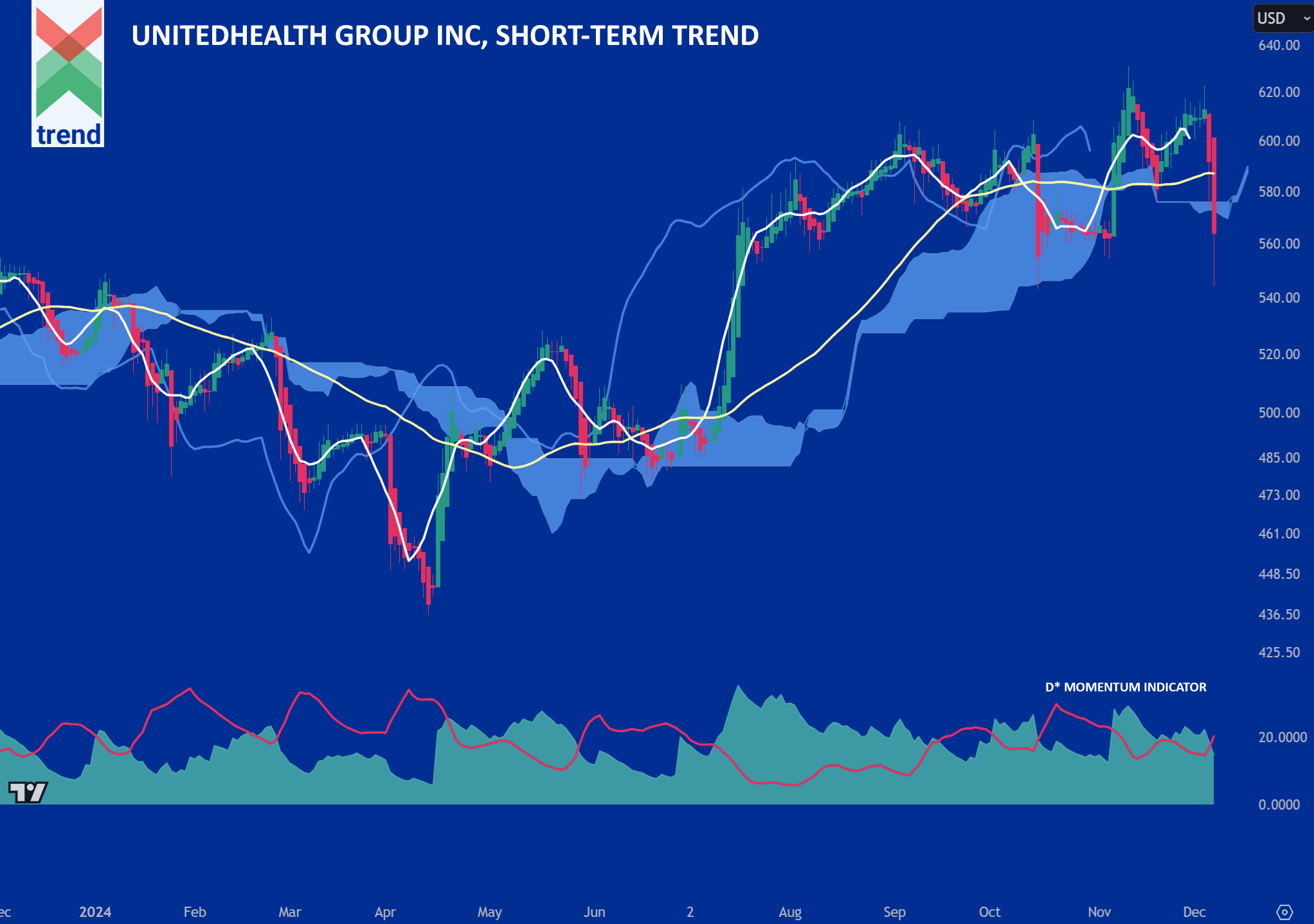

Trend’s Analysis (click chart to expand): In our UnitedHealth Group chart, Trend Intelligence displays a slightly negative trending D* Momentum Indicator with the red (-D*) line just starting to outstrip the green (+D*) area. This is, and has shown over time to be, the beginnings of a negative trend.

In addition to our D* indicator, price currently trades below Trend’s Japanese Cloud (in blue shading) and now below our yellow medium-term moving average.

The combination of all signals corroborates Trend’s negative short-term trend rating on UnitedHealth, as we project continued downward moves in its share price until the trend shows signs of reversing.

Downside Sentiment: In October this year, industry leader UnitedHealth and its closest rival Elevance cautioned that mismatches between reimbursement rates and higher than expected medical expenses would pressure their earnings. This being a direct result of the Biden administration having lowered payment rates for private medicare plans, reported the Financial Times.

Upside Sentiment: Yesterday, Wells Fargo’s analyst Stephen Baxter maintained a Buy rating on UnitedHealth and set a price target of $677, owing to its favourable financial guidance and performance expectations. The company’s 2025 earnings per share (EPS) guidance is also anticipated to grow by 7.2% year-over-year, reports Business Insider.

Authored by: Trend Intelligence, London