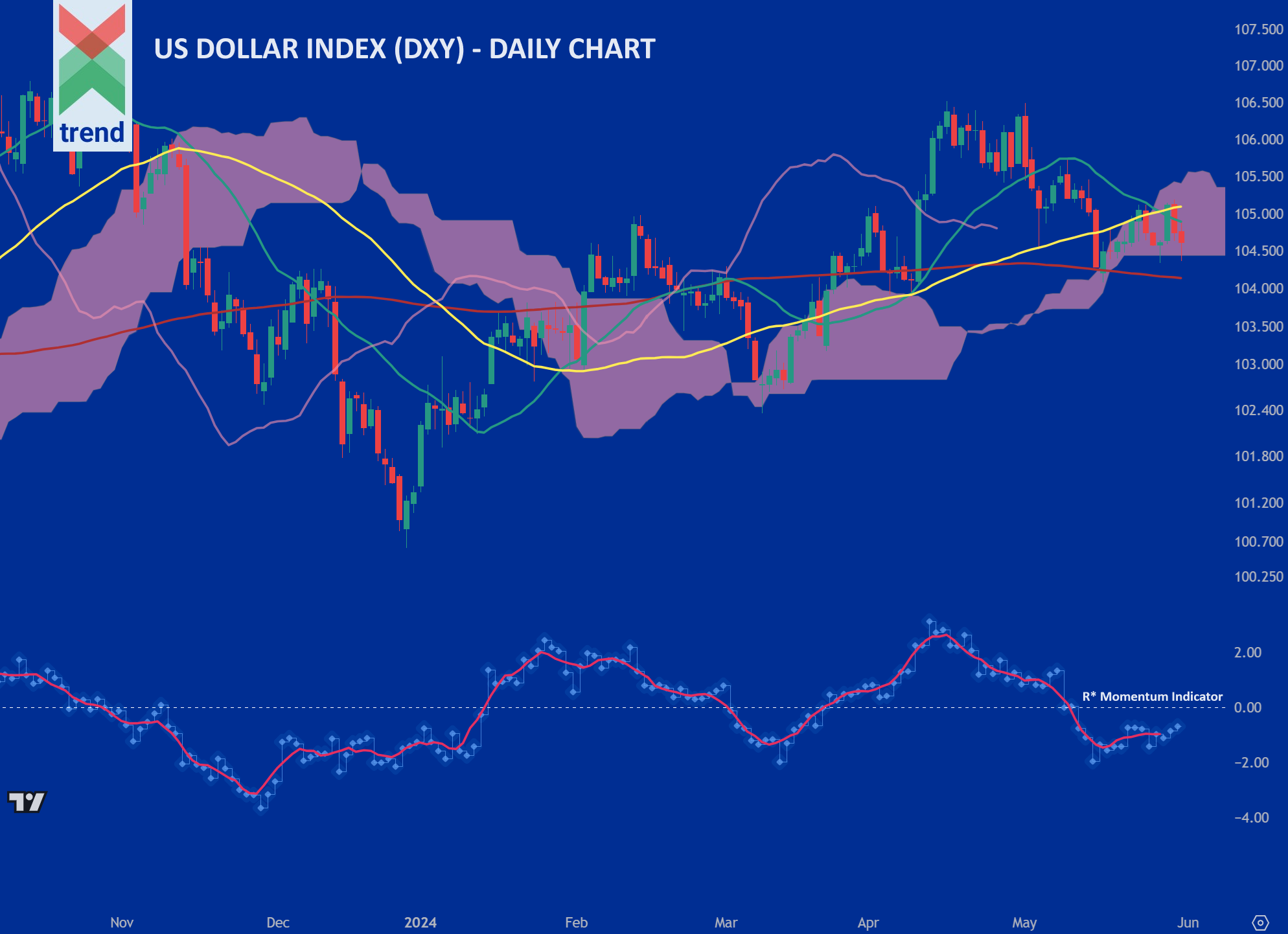

May 31st 2024 – The pricing of the US Dollar against a basket of global currencies, known as the US Dollar Index (or DXY) is now exhibiting a negative short-term trend reports Trend Intelligence, as the index has fallen around 1.5% from its late April/early May 2024 high and now trades at around 105 points.

Trend’s Analysis (click chart to expand): Trend’s R* Momentum Indicator creates a clear visual representation of price trends in play across asset classes and financial instruments. In our US Dollar Index chart, Trend Intelligence reports negatively trending R* and R* Signal lines, with both indicators now operating below the critical zero line. This is, and has shown over time to be, a negative trend signal.

In addition to the R* indicator, price currently trades below 2 of Trend’s moving averages (short-term and medium-term) and within our Japanese Cloud indicator in pink shading.

The combination of these signals corroborates Trend’s negative short-term trend rating on the DXY Index looking negative for the future weeks ahead.

Downside Sentiment: The dollar fell this week after revised data showed that gross domestic product grew at slower pace than previously expected in the first quarter. The U.S. economy grew at a 1.3% annualized rate from January through March, reduced from an expected 1.6% after there were changes to consumer spending, reports Reuters News.

Upside Sentiment: The prospect of less easing by the Federal Reserve (Fed) this year has taken the dollar to new highs — and should underpin its strength going forward. This is particularly true if other developed market central banks act to cut interest rates before the Fed, reports JP Morgan.

Authored by: Trend Intelligence, London